Growth in Industrial Automation

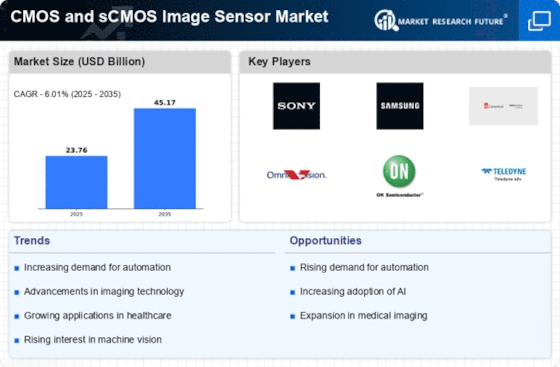

The increasing adoption of industrial automation technologies is emerging as a vital driver for the CMOS and sCMOS Image Sensor Market. Industries are increasingly utilizing imaging sensors for quality control, process monitoring, and machine vision applications. The industrial automation market is expected to grow at a CAGR of 9% over the next few years, which will likely boost the demand for high-performance imaging sensors. CMOS and sCMOS sensors are particularly suited for these applications due to their high sensitivity and resolution. As industries continue to embrace automation, the CMOS and sCMOS Image Sensor Market is poised for substantial growth, reflecting the broader trend towards efficiency and precision in manufacturing processes.

Advancements in Consumer Electronics

The continuous advancements in consumer electronics, particularly in smartphones and digital cameras, are propelling the CMOS and sCMOS Image Sensor Market. As manufacturers strive to enhance user experience, the demand for high-quality imaging capabilities is paramount. The smartphone market alone is projected to reach over 1.5 billion units by 2025, with a significant portion of this growth attributed to improved camera technologies. Innovations such as multi-lens systems and enhanced low-light performance are driving the need for advanced imaging sensors. Consequently, the CMOS and sCMOS Image Sensor Market is likely to benefit from these trends, as consumer expectations for superior imaging capabilities continue to rise.

Expansion of Automotive Applications

The automotive sector's rapid evolution towards advanced driver-assistance systems (ADAS) and autonomous vehicles is significantly influencing the CMOS and sCMOS Image Sensor Market. These applications require high-performance imaging sensors for functionalities such as lane departure warnings, collision avoidance, and parking assistance. The market for automotive imaging sensors is expected to reach USD 5 billion by 2026, reflecting a robust CAGR of around 10%. This growth is driven by the increasing integration of imaging technologies in vehicles, which enhances safety and driving experience. As automotive manufacturers continue to innovate, the demand for advanced CMOS and sCMOS sensors is likely to escalate, further solidifying their role in the automotive landscape.

Surge in Security and Surveillance Needs

The heightened focus on security and surveillance in both public and private sectors is a crucial driver for the CMOS and sCMOS Image Sensor Market. With increasing concerns over safety, there is a growing deployment of surveillance systems that utilize high-quality imaging sensors. The CMOS and sCMOS Image Sensor is anticipated to grow at a CAGR of 10% through 2025, which directly correlates with the demand for advanced imaging technologies. CMOS and sCMOS sensors are favored for their ability to deliver high-resolution images in various lighting conditions, making them ideal for security applications. This trend indicates a sustained growth trajectory for the CMOS and sCMOS Image Sensor Market as security needs continue to evolve.

Rising Demand for High-Resolution Imaging

The increasing demand for high-resolution imaging across various sectors is a primary driver for the CMOS and sCMOS Image Sensor Market. Applications in medical imaging, automotive, and consumer electronics necessitate sensors that can deliver superior image quality. For instance, the medical imaging sector is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 7.5% over the next few years. This growth is largely attributed to advancements in imaging technologies that require high-resolution sensors. Furthermore, the consumer electronics market, particularly smartphones and cameras, is also witnessing a surge in demand for high-resolution capabilities, thereby propelling the CMOS and sCMOS Image Sensor Market forward.