Advancements in Robotics

The integration of 3D sensors in robotics is a pivotal driver for the 3D Sensor Market. As robotics technology evolves, the need for precise spatial awareness and object recognition becomes paramount. 3D sensors provide robots with the capability to perceive their environment in three dimensions, enabling them to perform complex tasks with greater accuracy. The robotics sector is anticipated to expand significantly, with projections indicating a market growth rate of around 15% annually. This growth is fueled by the increasing deployment of robots in sectors such as manufacturing, healthcare, and logistics, where 3D sensors play a crucial role in enhancing operational capabilities.

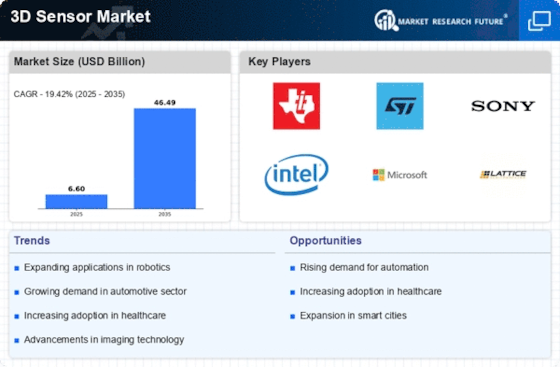

Increased Focus on Smart Cities

The development of smart cities is emerging as a significant driver for the 3D Sensor Market. As urban areas strive to enhance infrastructure and improve the quality of life for residents, the integration of 3D sensors into city planning and management is becoming essential. These sensors facilitate efficient traffic management, environmental monitoring, and public safety initiatives. With investments in smart city projects projected to exceed 1 trillion by 2025, the demand for 3D sensors is likely to rise correspondingly. This trend underscores the potential for the 3D Sensor Market to play a vital role in shaping the future of urban environments.

Enhancements in Consumer Electronics

The 3D Sensor Market is also benefiting from advancements in consumer electronics. As devices such as smartphones, tablets, and gaming consoles increasingly incorporate 3D sensing technologies, the market is poised for substantial growth. The integration of 3D sensors allows for features such as facial recognition, gesture control, and enhanced photography capabilities. Recent estimates indicate that the consumer electronics sector is expected to grow at a rate of approximately 8% annually, driven by the demand for innovative features that enhance user experience. This trend suggests a promising outlook for the 3D Sensor Market as it aligns with the evolving landscape of consumer technology.

Rising Demand in Industrial Automation

The 3D Sensor Market is experiencing a notable surge in demand due to the increasing adoption of automation in various industrial sectors. Industries such as manufacturing and logistics are integrating 3D sensors to enhance operational efficiency and precision. According to recent data, the market for industrial automation is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This growth is largely driven by the need for improved quality control and real-time monitoring, which 3D sensors facilitate. As companies strive to optimize their production processes, the reliance on advanced sensing technologies is likely to escalate, thereby propelling the 3D Sensor Market forward.

Growth in Augmented and Virtual Reality

The 3D Sensor Market is significantly influenced by the burgeoning fields of augmented reality (AR) and virtual reality (VR). These technologies rely heavily on 3D sensing capabilities to create immersive experiences. As the demand for AR and VR applications in gaming, education, and training continues to rise, the need for advanced 3D sensors is becoming increasingly apparent. Market analysis suggests that the AR and VR market could reach a valuation of over 200 billion by 2025, with 3D sensors being integral to the development of these applications. This trend indicates a robust growth trajectory for the 3D Sensor Market as it aligns with the technological advancements in immersive experiences.