Government Support and Investment

The Saudi government is actively supporting the agrochemical sector, which significantly influences the Saudi Arabia Agrochemical and Pesticides Market. Through various initiatives, including financial incentives and research funding, the government aims to boost agricultural productivity and sustainability. In 2025, government investments in agricultural technology and agrochemical research are projected to exceed $1 billion, reflecting a commitment to enhancing the sector. This support not only encourages local production of agrochemicals but also attracts foreign investment, fostering a competitive market environment. As a result, the Saudi Arabia Agrochemical and Pesticides Market is likely to benefit from increased innovation and a wider range of products available to farmers.

Increasing Agricultural Production

The demand for agrochemicals and pesticides in Saudi Arabia Agrochemical and Pesticides Market is driven by the need to enhance agricultural productivity. With the country's focus on achieving food security, there is a significant push towards increasing crop yields. The Saudi government has implemented various initiatives to support farmers, including subsidies for agrochemical products. In 2025, the agricultural sector is projected to grow at a rate of 4.5%, leading to an increased consumption of fertilizers and pesticides. This growth is essential for meeting the food demands of a growing population, which is expected to reach 40 million by 2030. Consequently, the Saudi Arabia Agrochemical and Pesticides Market is likely to witness a surge in demand for innovative and effective agrochemical solutions.

Rising Awareness of Crop Protection

There is a growing awareness among farmers in Saudi Arabia regarding the importance of crop protection, which is a key driver for the Saudi Arabia Agrochemical and Pesticides Market. As agricultural practices evolve, farmers are recognizing the need for effective pest and disease management to safeguard their yields. In 2025, it is estimated that the market for crop protection products will grow by 10%, driven by this heightened awareness. Educational programs and workshops organized by agricultural organizations are further promoting the use of agrochemicals for effective crop management. This trend indicates a shift towards more informed agricultural practices, ultimately benefiting the Saudi Arabia Agrochemical and Pesticides Market.

Shift Towards Sustainable Agriculture

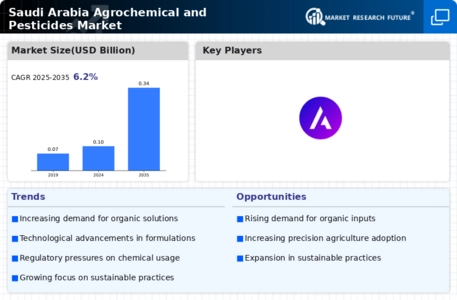

The Saudi Arabia Agrochemical and Pesticides Market is experiencing a notable shift towards sustainable agricultural practices. Farmers are increasingly adopting eco-friendly pesticides and fertilizers to minimize environmental impact. This trend is partly driven by consumer preferences for organic produce, which has seen a rise in demand. In 2025, the market for organic food in Saudi Arabia is anticipated to grow by 15%, prompting farmers to seek sustainable agrochemical solutions. Additionally, the government is promoting sustainable practices through various programs and incentives, encouraging the use of biopesticides and organic fertilizers. This shift not only aligns with global sustainability goals but also enhances the reputation of Saudi agricultural products in international markets.

Technological Innovations in Agrochemicals

Technological advancements are playing a crucial role in shaping the Saudi Arabia Agrochemical and Pesticides Market. The introduction of precision agriculture technologies, such as drones and satellite imaging, allows for more efficient application of agrochemicals. These innovations enable farmers to optimize their use of pesticides and fertilizers, reducing waste and increasing effectiveness. In 2025, it is estimated that the adoption of smart farming technologies will increase by 20%, leading to a more efficient agrochemical application process. Furthermore, research and development in the field of agrochemicals are yielding new products that are more effective and environmentally friendly. This technological evolution is likely to enhance productivity and sustainability within the Saudi Arabia Agrochemical and Pesticides Market.