Government Initiatives and Support

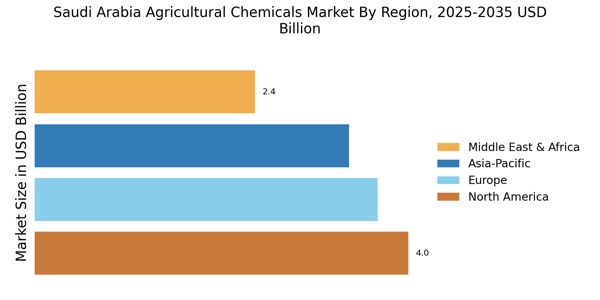

The GCC Agrochemicals Market benefits significantly from various government initiatives aimed at promoting agricultural sustainability and innovation. Countries like Saudi Arabia and Qatar have introduced subsidies and financial incentives for farmers to adopt modern agrochemical practices. The Saudi Vision 2030 plan emphasizes agricultural development, which includes enhancing the use of agrochemicals to improve crop yields. Additionally, the GCC governments are investing in research and development to create more effective and environmentally friendly agrochemical products. This supportive regulatory environment is expected to foster growth in the GCC Agrochemicals Market, as it encourages the adoption of advanced agrochemical solutions among farmers.

Increasing Agricultural Production

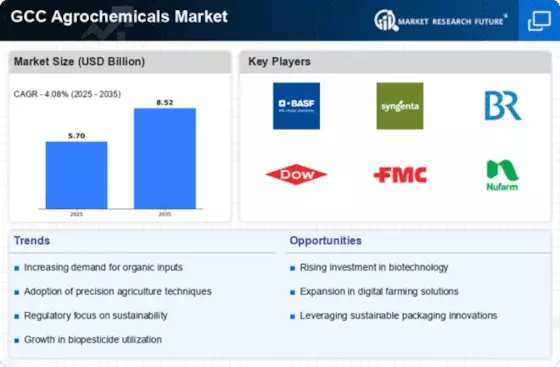

The GCC Agrochemicals Market is experiencing a surge in demand driven by the need to enhance agricultural productivity. With the region's growing population, which is projected to reach over 60 million by 2030, the pressure on food production systems intensifies. Governments in GCC countries are implementing policies to boost local food production, thereby increasing the adoption of agrochemicals. For instance, the UAE has set ambitious targets to increase its food security, leading to a projected growth rate of 5.5% in the agrochemicals sector by 2026. This focus on agricultural output is likely to propel the GCC Agrochemicals Market forward, as farmers seek effective solutions to maximize yields and ensure food supply stability.

Rising Awareness of Sustainable Practices

There is a growing awareness among farmers in the GCC region regarding sustainable agricultural practices, which is influencing the GCC Agrochemicals Market. As consumers increasingly demand organic and sustainably produced food, farmers are seeking agrochemical solutions that align with these preferences. The market for bio-based agrochemicals is projected to grow at a compound annual growth rate of 7% through 2026, reflecting this shift. Furthermore, initiatives promoting integrated pest management and reduced chemical usage are gaining traction, leading to a transformation in how agrochemicals are perceived and utilized. This trend towards sustainability is likely to reshape the GCC Agrochemicals Market, driving innovation and the development of eco-friendly products.

Technological Advancements in Agrochemicals

Technological advancements are playing a pivotal role in shaping the GCC Agrochemicals Market. Innovations such as precision agriculture, drone technology, and data analytics are enabling farmers to optimize the use of agrochemicals, thereby enhancing efficiency and reducing waste. The integration of smart technologies in farming practices is expected to increase the demand for specialized agrochemical products tailored to specific crop needs. For instance, the use of drones for targeted pesticide application can lead to a reduction in chemical usage by up to 30%. As these technologies become more accessible, they are likely to drive growth in the GCC Agrochemicals Market, as farmers seek to leverage these advancements for better crop management.

Expansion of Crop Varieties and Cultivation Areas

The expansion of crop varieties and cultivation areas in the GCC region is a significant driver for the GCC Agrochemicals Market. As farmers diversify their crops to include high-value fruits and vegetables, the demand for specific agrochemical products tailored to these crops increases. Additionally, the reclamation of arid lands for agricultural purposes is creating new opportunities for agrochemical applications. For example, the introduction of salt-tolerant crop varieties in Saudi Arabia is expected to boost the agrochemical market as these crops require specialized nutrients and pest control solutions. This diversification and expansion are likely to stimulate growth in the GCC Agrochemicals Market, as farmers seek effective agrochemical solutions to support their evolving agricultural practices.