Top Industry Leaders in the Saudi Arabia Agrochemical Pesticides Market

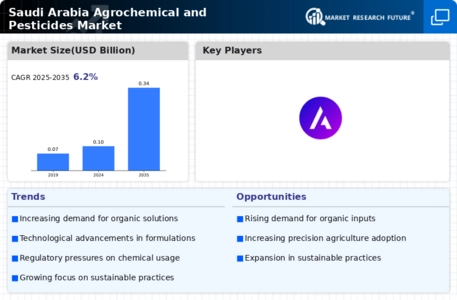

The Saudi Arabian agrochemical and pesticides market is a dynamic region experiencing steady growth driven by several factors, including increasing population and food demand, government initiatives promoting agricultural development, and adoption of modern farming techniques. This fertile ground for opportunity also breeds a fiercely competitive landscape, where established players and aspiring entrants tussle for market share

Market Share Movers and Shakers:

-

Global Giants Hold Sway: Multinational corporations like BASF SE, Bayer AG, Syngenta AG, and FMC Corporation dominate the market with their established distribution networks, comprehensive product portfolios, and strong brand recognition. Their research and development prowess keeps them at the forefront of innovative solutions, further solidifying their positions. -

Local Champions Emerge: Domestic players like The Arab Pesticides and Veterinary Drugs Mfg. Co. (APVD) and Saudi Delta Company Inc. are carving their niches by strategically catering to local needs and regulations. Their familiarity with regional agricultural practices and competitive pricing enable them to capture significant market share, especially in specific segments like bio-pesticides. -

New Entrants Disrupt: The market witnesses a steady influx of smaller companies offering specialized products or targeting niche segments. Startups focused on bio-based and organic solutions are gaining traction, driven by the rising demand for sustainable farming practices.

Strategies Shaping the Game:

-

Product Diversification: Leading players are expanding their portfolios beyond traditional pesticides to include fertilizers, plant growth regulators, and bio-control agents. This comprehensive approach caters to diversified farmer needs and strengthens brand loyalty. -

Technological Prowess: R&D investments are paramount, particularly in developing pest-resistant crop varieties, safer and more targeted agrochemicals, and digital farming solutions. Early adopters of these technologies gain a competitive edge. -

Distribution Channel Mastery: Building strong relationships with retailers, cooperatives, and government agencies ensures efficient product reach and market penetration. Local players excel in navigating the unique distribution landscape of Saudi Arabia. -

Sustainability Focus: With growing environmental concerns, companies are emphasizing eco-friendly solutions like bio-pesticides and integrated pest management (IPM) strategies. Demonstrating a commitment to sustainability attracts both environmentally conscious consumers and government support.

Key Companies in the agrochemical and pesticides market include

- BASF SE

- Bayer AG

- Saudi Delta Company Inc

- Astra

- The Arab Pesticides and Veterinary Drugs Mfg. Co (Mobedco)

- Saudi United Fertilizer Co

- Alahmari Group

- Montajat Veterinary Pharmaceuticals Co., Ltd.

Recent Developments

August 2023: Saudi Arabia's Ministry of Environment, Water, and Agriculture announces a new program to promote the adoption of biopesticides and IPM practices, providing financial incentives for farmers.

October 2023: BASF launches a new biological insecticide specifically targeting fall armyworm, a major pest affecting maize crops in the region.

November 2023: The Saudi Arabian Agricultural Investment Company (SAGIA) signs a memorandum of understanding with a leading Chinese agrochemical company to establish a joint venture for pesticide production in the Kingdom.