Emergence of Commercial Space Ventures

The emergence of commercial space ventures is reshaping the Satellite Propulsion System Market. Private companies are increasingly entering the space sector, driven by the potential for profit and innovation. This trend has led to a surge in satellite launches, with commercial entities accounting for a significant portion of the market. The rise of small satellite constellations, particularly for applications such as Internet of Things (IoT) connectivity and Earth observation, is creating new opportunities for propulsion system manufacturers. As these companies seek to optimize costs and enhance satellite capabilities, the demand for advanced propulsion technologies is expected to rise. This dynamic environment is likely to foster competition and innovation within the Satellite Propulsion System Market, as companies strive to differentiate their offerings and capture market share.

Advancements in Propulsion Technologies

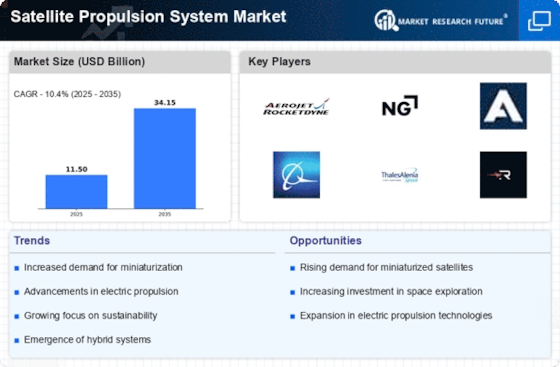

The Satellite Propulsion System Market is experiencing a notable transformation due to advancements in propulsion technologies. Innovations such as ion thrusters and electric propulsion systems are gaining traction, offering enhanced efficiency and reduced fuel consumption. These technologies enable satellites to achieve longer operational lifespans and greater maneuverability in orbit. As a result, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the increasing demand for high-performance satellites that can support various applications, including telecommunications, Earth observation, and scientific research. The integration of cutting-edge propulsion systems is likely to redefine operational capabilities, making them a focal point for manufacturers and service providers in the Satellite Propulsion System Market.

Government Investments in Space Programs

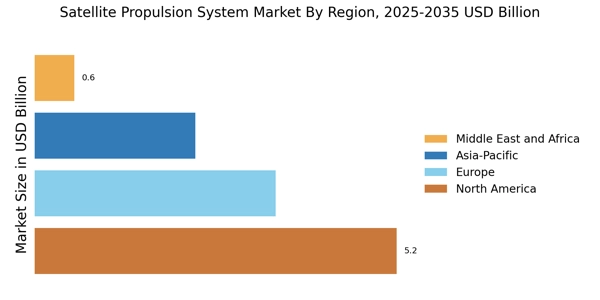

Government investments in space programs are playing a crucial role in shaping the Satellite Propulsion System Market. Various nations are increasing their budgets for space exploration and satellite deployment, recognizing the strategic importance of space capabilities. For instance, the United States has allocated significant funding for NASA and other space agencies, which directly impacts the demand for advanced propulsion systems. This trend is mirrored in other countries, where national security and technological leadership drive investments in satellite technologies. As governments prioritize space initiatives, the Satellite Propulsion System Market is likely to benefit from increased contracts and collaborations with private sector players. This influx of funding is expected to accelerate research and development efforts, leading to innovative propulsion solutions that meet the evolving needs of the space sector.

Increasing Demand for Satellite Services

The Satellite Propulsion System Market is significantly influenced by the rising demand for satellite services across various sectors. As industries such as telecommunications, broadcasting, and remote sensing expand, the need for reliable and efficient satellite systems becomes paramount. The market for satellite services is expected to reach USD 300 billion by 2026, indicating a robust growth trajectory. This surge in demand necessitates advanced propulsion systems that can support the deployment and maintenance of a growing number of satellites in orbit. Consequently, manufacturers are focusing on developing propulsion solutions that enhance satellite performance and reduce operational costs. The interplay between service demand and propulsion technology development is likely to shape the future landscape of the Satellite Propulsion System Market.

Focus on Miniaturization of Satellite Systems

The focus on miniaturization of satellite systems is a key driver in the Satellite Propulsion System Market. As satellites become smaller and lighter, the propulsion systems must also adapt to meet these new requirements. Miniaturized propulsion technologies, such as microthrusters, are being developed to provide efficient thrust while occupying minimal space. This trend is particularly relevant for small satellite applications, where weight and size constraints are critical. The market for small satellites is projected to grow significantly, with estimates suggesting that over 10,000 small satellites could be launched by 2030. This proliferation of small satellites necessitates innovative propulsion solutions that can support their unique operational needs. Consequently, the Satellite Propulsion System Market is likely to witness a surge in demand for compact and efficient propulsion systems that align with the miniaturization trend.