Satellite Propulsion System Size

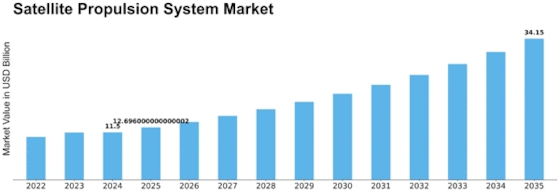

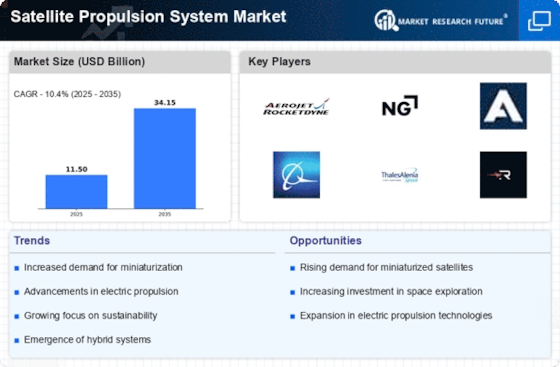

Satellite Propulsion System Market Growth Projections and Opportunities

The Satellite Propulsion System Market is characterized by dynamic and evolving market dynamics driven by the growing demand for satellite launches, advancements in satellite technologies, and the expansion of satellite-based applications. One key market dynamic is the increasing deployment of small satellites for various purposes, including Earth observation, communication, and scientific research. The rise of small satellite constellations, driven by the miniaturization of satellite components and cost-effective launch options, contributes to the demand for efficient and reliable satellite propulsion systems. Market dynamics are shaped by the need for propulsion systems that cater to the unique requirements of small satellites, offering versatility and adaptability.

Technological advancements play a pivotal role in the Satellite Propulsion System Market dynamics. As satellite missions become more complex, requiring longer lifespans and extended maneuverability, propulsion systems evolve to meet these demands. Advancements in propulsion technologies, such as the development of electric propulsion systems like ion and Hall-effect thrusters, contribute to market dynamics by offering enhanced fuel efficiency and prolonged satellite operational lifetimes. The push for innovation influences market dynamics as manufacturers strive to stay at the forefront of propulsion technology, meeting the evolving needs of satellite operators.

Increasing commercial satellite launches and the rise of new entrants in the space industry contribute to market dynamics in the Satellite Propulsion System Market. The growing commercialization of space and the emergence of private space companies drive market dynamics by increasing the frequency of satellite launches. This surge in demand requires efficient and reliable propulsion systems to propel satellites into their intended orbits. Market dynamics are influenced by the competition among satellite propulsion system manufacturers to provide cost-effective and high-performance solutions to both traditional space agencies and new entrants in the satellite launch market.

The trend toward satellite servicing and in-orbit maintenance represents a significant market dynamic. As the number of satellites in orbit increases, there is a growing emphasis on extending the operational life of satellites through maintenance and servicing missions. Satellite propulsion systems play a crucial role in these dynamics, facilitating orbital maneuvers, station-keeping, and deorbiting operations. Market dynamics are shaped by the evolving landscape of in-orbit servicing, with propulsion systems becoming integral to the sustainability and longevity of satellite missions.

Regulatory initiatives and environmental considerations contribute to market dynamics in the Satellite Propulsion System Market. Governments and space agencies are increasingly focused on mitigating space debris and ensuring responsible space activities. Market dynamics are influenced by the need for propulsion systems that enable controlled satellite deorbiting at the end of their missions, reducing the risk of space debris. Regulatory standards and guidelines for satellite disposal drive market dynamics by shaping the design and functionality of propulsion systems to align with responsible space practices.

Global geopolitical trends impact market dynamics in the Satellite Propulsion System Market. The increasing interest in space exploration and satellite capabilities by various nations drives market dynamics, with space becoming a strategic domain. The demand for satellite propulsion systems is influenced by geopolitical considerations, reflecting the strategic importance of space assets for communication, surveillance, and scientific research. Market dynamics are shaped by the competition among nations to enhance their space capabilities, leading to increased investments in satellite propulsion technologies.

The evolution of satellite applications, including mega-constellations for global broadband connectivity and Earth observation for environmental monitoring, contributes to market dynamics in the Satellite Propulsion System Market. These applications drive the demand for satellite fleets with specific orbital requirements and operational characteristics. Market dynamics are influenced by the need for propulsion systems that can support the deployment, maintenance, and repositioning of large satellite constellations, reflecting the changing landscape of satellite-based services.

Research and development investments are crucial market dynamics in the Satellite Propulsion System Market. Manufacturers actively engage in R&D initiatives to enhance the efficiency, reliability, and performance of satellite propulsion systems. Market dynamics are shaped by ongoing efforts to explore innovative propulsion technologies, materials, and design approaches that address the evolving requirements of satellite operators. The pursuit of cutting-edge solutions drives market dynamics by positioning companies at the forefront of technological advancements in satellite propulsion systems

Leave a Comment