Economic Incentives and Cost Savings

Economic factors significantly influence the Marine Hybrid Propulsion System Market, particularly in terms of cost savings and operational efficiency. The rising cost of traditional fuels, coupled with the increasing availability of alternative energy sources, makes hybrid propulsion systems an economically viable option for ship operators. Studies indicate that vessels equipped with hybrid systems can achieve fuel savings of up to 30% compared to conventional systems. Additionally, many governments are offering financial incentives, such as tax breaks and subsidies, to encourage the adoption of cleaner technologies. These economic incentives not only lower the initial investment barrier but also enhance the long-term profitability of hybrid vessels. As a result, the Marine Hybrid Propulsion System Market is likely to experience robust growth driven by these economic considerations.

Competitive Landscape and Market Dynamics

The competitive landscape of the Marine Hybrid Propulsion System Market is evolving rapidly, characterized by the entry of new players and strategic partnerships among established companies. As the demand for hybrid systems grows, manufacturers are investing in research and development to enhance their product offerings. This competitive environment fosters innovation and drives down costs, making hybrid propulsion systems more accessible to a broader range of customers. Additionally, collaborations between technology providers and shipbuilders are becoming increasingly common, facilitating the development of integrated solutions that meet diverse customer needs. Market dynamics are further influenced by the increasing focus on digitalization and automation in the maritime sector, which enhances operational efficiency. As a result, the Marine Hybrid Propulsion System Market is likely to experience heightened competition and innovation in the coming years.

Technological Innovations and Advancements

Technological advancements play a pivotal role in shaping the Marine Hybrid Propulsion System Market. Innovations in battery technology, energy management systems, and hybrid engine designs are enhancing the efficiency and performance of marine vessels. For example, the integration of advanced energy storage solutions allows for longer operational ranges and reduced fuel consumption. Furthermore, the development of smart propulsion systems that optimize fuel usage based on real-time data is gaining traction. These innovations not only improve operational efficiency but also reduce operational costs, making hybrid systems more attractive to ship operators. The market is witnessing a surge in research and development activities, with investments in innovative technologies expected to exceed USD 1 billion by 2026. This focus on technological progress is likely to propel the Marine Hybrid Propulsion System Market forward.

Growing Demand for Sustainable Shipping Solutions

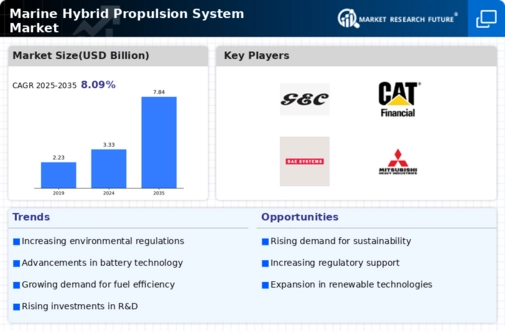

The Marine Hybrid Propulsion System Market is witnessing a surge in demand for sustainable shipping solutions as environmental awareness among consumers and businesses increases. Stakeholders are increasingly prioritizing eco-friendly practices, leading to a shift in the maritime industry towards greener technologies. Hybrid propulsion systems, which combine traditional engines with electric power, offer a compelling solution to reduce emissions and improve fuel efficiency. This shift is reflected in the growing number of orders for hybrid vessels, with estimates suggesting that the market for hybrid propulsion systems could reach USD 5 billion by 2027. The increasing emphasis on sustainability is not only driven by regulatory requirements but also by consumer preferences for environmentally responsible shipping practices. Consequently, the Marine Hybrid Propulsion System Market is poised for significant expansion.

Regulatory Compliance and Environmental Standards

The Marine Hybrid Propulsion System Market is increasingly influenced by stringent regulatory frameworks aimed at reducing emissions and promoting sustainable practices. Governments worldwide are implementing regulations that mandate lower greenhouse gas emissions from marine vessels. For instance, the International Maritime Organization has set ambitious targets for reducing carbon emissions by 50% by 2050. This regulatory pressure compels shipbuilders and operators to adopt hybrid propulsion systems, which offer a viable solution to meet these standards. As a result, the demand for hybrid systems is expected to rise, with projections indicating a compound annual growth rate of over 10% in the coming years. Compliance with these regulations not only enhances environmental performance but also improves the marketability of vessels, thereby driving growth in the Marine Hybrid Propulsion System Market.