Top Industry Leaders in the Satellite Propulsion System Market

Introduction:

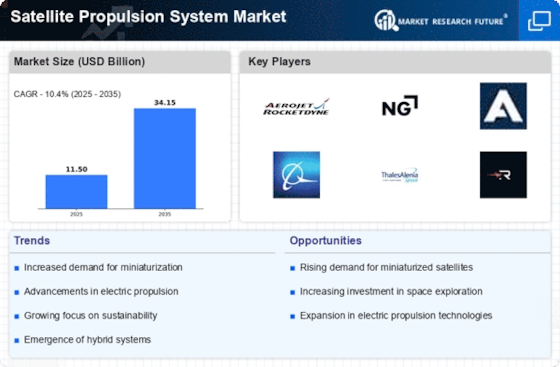

The competitive landscape of the Satellite Propulsion System Market is undergoing rapid transformation, driven by the increasing demand for satellite deployment and maintenance. Satellite propulsion systems are essential components that enable orbit adjustments, station-keeping, and overall satellite maneuverability. To understand the competitive dynamics of this market, it is crucial to examine key players, their strategies, market share analysis factors, new entrants, industry news, and the current investment trends shaping the industry.

Key Players:

- Aerojet Rocketdyne (U.S.),

- Bellatrix Aerospace (India),

- Mitsubishi Electric Corporation (Japan),

- Airbus Defense and Space (France),

- Boeing (U.S.),

- Safran S.A. (France),

- OHB System AG (Germany),

- Ball Aerospace & Technologies Corp. (U.S.),

- Thales Group (France),

- Orbital ATK Inc. (U.S.)

Strategies Adopted:

Key players in the Satellite Propulsion System Market employ strategic approaches to maintain a competitive edge. Continuous investment in research and development (R&D) allows companies to enhance the efficiency and performance of their propulsion systems. Strategic partnerships with satellite manufacturers and space agencies enable companies to integrate their propulsion systems into a broader range of satellite platforms. Additionally, a focus on cost-effective solutions and modular designs ensures adaptability to diverse mission profiles.

Factors for Market Share Analysis:

Market share analysis in the Satellite Propulsion System Market is multifaceted, considering factors such as propulsion system efficiency, versatility, and adaptability. Companies with a broad product portfolio covering various propulsion technologies, including chemical and electric propulsion, tend to capture a larger market share. Reliability, compliance with international space regulations, and successful track records in satellite missions are also critical factors influencing market share.

New and Emerging Companies:

The satellite propulsion sector has witnessed the emergence of new players bringing innovative solutions to the market. Companies like Phase Four and Accion Systems focus on electric propulsion technologies, aiming to address the growing demand for fuel-efficient and long-duration satellite missions. These new entrants contribute to diversifying propulsion options and driving technological advancements in the market.

Industry News:

Recent industry news in the Satellite Propulsion System Market has highlighted key developments and collaborations. Companies frequently announce successful satellite missions powered by their propulsion systems, showcasing the reliability and efficiency of their technologies. Furthermore, news often revolves around advancements in propulsion technologies, such as the development of more powerful and lightweight engines, reinforcing the industry's commitment to innovation.

Current Company Investment Trends:

Investment trends in the Satellite Propulsion System Market reveal a consistent focus on research, development, and innovation. Major players allocate substantial resources to advance propulsion technologies, aiming for greater efficiency, reduced mass, and increased reliability. Investments in manufacturing capabilities and production scalability are also evident, reflecting the anticipation of a growing market with increasing demand for satellite propulsion systems.

Overall Competitive Scenario:

The overall competitive scenario in the Satellite Propulsion System Market is characterized by intense competition among key players vying for market leadership. Companies are strategically positioning themselves to address the evolving needs of the satellite industry, from small satellites to large constellations. The pursuit of sustainable and cost-effective propulsion solutions aligns with the broader goals of the space industry. Collaborations and partnerships between propulsion system manufacturers and satellite integrators contribute to the creation of comprehensive satellite solutions, further intensifying the competition.

Recent Development:

December 2023, NASA granted Blue Origin a NASA Launch Services II Indefinite Delivery Indefinite Quantity (IDIQ) contract. The contract aims to utilize Blue Origin's New Glenn, an orbital reusable launch vehicle, for launching various satellites dedicated to planetary exploration, Earth observation, and scientific endeavours.

February 2023, NASA's Launch Services Program (LSP) awarded Blue Origin the ESCAPADE contract. Within this contract, Blue Origin will deploy its New Glenn reusable technology to facilitate the Escape and Plasma Acceleration and Dynamics Explorers (ESCAPADE) mission.

February 2023, Thales Alenia Space secured a contract with the Korea Aerospace Research Institute (KARI) to deliver integrated electric propulsion for the GEO-KOMPSAT-3 (GK3) satellite. In December 2023, NASA granted Blue Origin a NASA Launch Services II Indefinite Delivery Indefinite Quantity (IDIQ) contract. The contract aims to utilize Blue Origin's New Glenn, an orbital reusable launch vehicle, for launching various satellites dedicated to planetary exploration, Earth observation, and scientific endeavours.

February 2023, NASA's Launch Services Program (LSP) awarded Blue Origin the ESCAPADE contract. Within this contract, Blue Origin will deploy its New Glenn reusable technology to facilitate the Escape and Plasma Acceleration and Dynamics Explorers (ESCAPADE) mission.

February 2023, Thales Alenia Space secured a contract with the Korea Aerospace Research Institute (KARI) to deliver integrated electric propulsion for the GEO-KOMPSAT-3 (GK3) satellite.