Culinary Versatility of Rice Flour

The culinary versatility of rice flour serves as a significant driver in the Global Rice Flour Industry. It is utilized in a myriad of culinary applications, ranging from traditional Asian dishes to modern gluten-free recipes. This adaptability allows rice flour to cater to diverse consumer preferences and dietary needs. As culinary trends evolve, the demand for rice flour in various cuisines is likely to grow, further enhancing its market presence. The ability to substitute rice flour for wheat flour in numerous recipes positions it as a favorable ingredient, appealing to both home cooks and professional chefs alike.

Rising Demand for Gluten-Free Products

The increasing consumer preference for gluten-free products is a pivotal driver in the Global Rice Flour Industry. As awareness of gluten-related disorders rises, more individuals are seeking alternatives to traditional wheat flour. Rice flour, being naturally gluten-free, is gaining traction among health-conscious consumers. This shift is reflected in the market's projected growth, with the Global Rice Flour Market expected to reach 553.4 USD Million in 2024. The demand for gluten-free options is not limited to baked goods; it extends to various food products, including snacks and sauces, thereby broadening the market's appeal.

Emerging Markets and Consumer Awareness

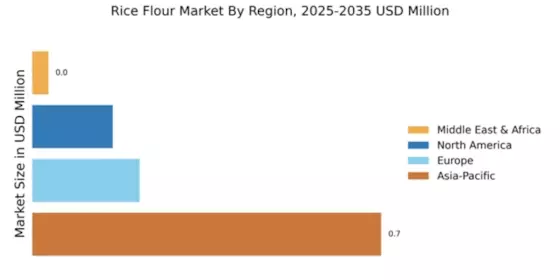

Emerging markets are playing a crucial role in the growth of the Global Rice Flour Industry. As economies develop, consumer awareness regarding health and nutrition is increasing, leading to a higher demand for rice flour products. Countries in Asia and Africa are witnessing a surge in rice flour consumption, driven by traditional culinary practices and the adoption of modern dietary trends. This shift is expected to bolster the market, as rice flour becomes a staple ingredient in various food products. The expanding middle class in these regions is likely to further enhance the demand for rice flour, contributing to its overall growth.

Expansion of the Food Processing Sector

The expansion of the food processing sector significantly influences the Global Rice Flour Industry. As food manufacturers increasingly incorporate rice flour into their products, the market experiences notable growth. Rice flour serves as a versatile ingredient in various applications, including bakery items, snacks, and sauces. This trend is underscored by the market's anticipated growth to 1355.0 USD Million by 2035, reflecting a compound annual growth rate of 8.48% from 2025 to 2035. The food processing industry's evolution, driven by innovation and consumer preferences, is likely to sustain the demand for rice flour in the coming years.

Health Benefits Associated with Rice Flour

The health benefits associated with rice flour are becoming increasingly recognized, thereby driving its demand in the Global Rice Flour Industry. Rice flour is low in fat and cholesterol, making it an appealing choice for health-conscious consumers. Additionally, it is rich in essential nutrients, including B vitamins and minerals. As consumers become more aware of the nutritional advantages of rice flour, its incorporation into various diets, including those for weight management and diabetes, is likely to increase. This trend is expected to contribute to the market's growth, as more individuals seek healthier alternatives in their food choices.