Increased Focus on Sustainability

The growing emphasis on sustainability within the healthcare sector significantly impacts the Refurbished Medical Imaging Equipment Market. As environmental concerns gain prominence, healthcare organizations are increasingly prioritizing eco-friendly practices. Refurbished equipment contributes to waste reduction by extending the lifecycle of medical devices, thereby minimizing the environmental footprint associated with manufacturing new equipment. This shift towards sustainable practices aligns with global initiatives aimed at reducing healthcare waste and promoting responsible consumption. Furthermore, healthcare facilities that adopt refurbished imaging equipment often report enhanced corporate social responsibility, which can improve their public image and attract environmentally conscious patients. The intersection of sustainability and healthcare purchasing decisions is likely to drive the demand for refurbished medical imaging equipment in the foreseeable future.

Rising Demand for Cost-Effective Solutions

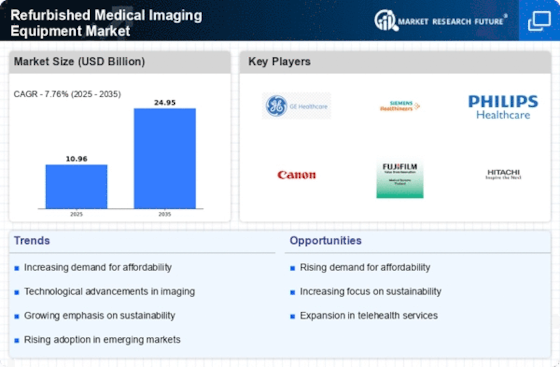

The Refurbished Medical Imaging Equipment Market experiences a notable increase in demand for cost-effective medical solutions. Healthcare facilities, particularly in emerging economies, are increasingly constrained by budget limitations, prompting them to seek affordable alternatives to new equipment. Refurbished imaging devices, which can be up to 50% less expensive than their new counterparts, provide a viable solution. This trend is further supported by the growing recognition of refurbished equipment's reliability and performance. As hospitals and clinics strive to optimize their operational budgets while maintaining high-quality patient care, the refurbished market is likely to expand. The increasing acceptance of refurbished devices among healthcare professionals indicates a shift in purchasing behavior, which could significantly influence market dynamics in the coming years.

Growing Awareness of Quality and Performance

There is a rising awareness among healthcare providers regarding the quality and performance of refurbished medical imaging equipment, which is shaping the Refurbished Medical Imaging Equipment Market. As more healthcare professionals share positive experiences and outcomes associated with refurbished devices, the stigma that once surrounded them is gradually dissipating. Studies indicate that refurbished imaging equipment can deliver comparable performance to new devices, often with the added benefit of lower costs. This growing recognition is encouraging healthcare facilities to consider refurbished options as viable alternatives. Additionally, educational initiatives and workshops aimed at informing healthcare providers about the benefits of refurbished equipment are gaining traction. As awareness continues to grow, it is likely that the market will see an increase in the adoption of refurbished medical imaging technologies, further solidifying their place in the healthcare landscape.

Regulatory Support for Refurbished Equipment

Regulatory bodies are increasingly recognizing the value of refurbished medical devices, which positively influences the Refurbished Medical Imaging Equipment Market. Policies that support the use of refurbished equipment are being implemented, as they can enhance access to essential medical technologies, particularly in underserved regions. Regulatory frameworks that streamline the certification and approval processes for refurbished devices help ensure that they meet safety and efficacy standards. This regulatory support not only boosts consumer confidence but also encourages manufacturers and suppliers to invest in refurbishment processes. As regulations evolve to favor the integration of refurbished equipment into healthcare systems, the market is likely to witness accelerated growth. The alignment of regulatory policies with market needs could create a more favorable environment for the proliferation of refurbished medical imaging technologies.

Technological Innovations in Refurbishment Processes

Technological advancements in refurbishment processes are transforming the Refurbished Medical Imaging Equipment Market. Enhanced techniques and methodologies for refurbishing imaging equipment ensure that devices meet stringent quality and safety standards. Innovations such as advanced imaging software and improved diagnostic capabilities are integrated into refurbished products, making them more appealing to healthcare providers. The market is witnessing a surge in the adoption of refurbished MRI and CT scanners, which are now equipped with cutting-edge technology that rivals new models. This trend not only boosts consumer confidence but also expands the potential customer base, as facilities that previously hesitated to invest in refurbished equipment are now more inclined to do so. The continuous evolution of refurbishment technology is likely to play a pivotal role in shaping the future landscape of the market.