Focus on Cost Reduction

Cost reduction remains a pivotal driver in the Global Procurement Software Market Industry. Organizations are under constant pressure to minimize expenses while maintaining quality and efficiency. Procurement software provides tools for better supplier management, contract negotiation, and spend analysis, enabling companies to identify cost-saving opportunities. As the market evolves, procurement software is expected to play a crucial role in achieving these objectives. The anticipated growth from 7 USD Billion in 2024 to 20.3 USD Billion by 2035 indicates a strong correlation between effective procurement strategies and financial performance. This focus on cost reduction is likely to propel the adoption of procurement software across various sectors.

Market Growth Projections

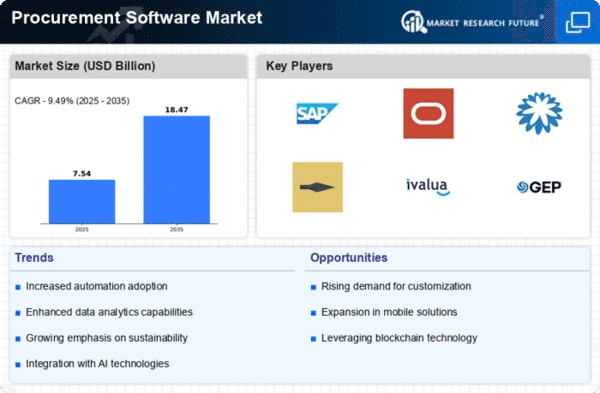

The Global Procurement Software Market Industry is poised for substantial growth, with projections indicating an increase from 7 USD Billion in 2024 to 20.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 10.18% from 2025 to 2035. Such projections highlight the increasing reliance on procurement software as organizations strive to enhance efficiency, reduce costs, and improve supplier relationships. The anticipated market expansion reflects the broader trends in digital transformation and the ongoing evolution of procurement practices across various industries. As businesses continue to adapt to changing market dynamics, the demand for innovative procurement solutions is likely to intensify.

Global Supply Chain Resilience

The Global Procurement Software Market Industry is significantly driven by the need for supply chain resilience. In an increasingly interconnected world, organizations are recognizing the importance of robust procurement strategies to withstand disruptions. Procurement software enables companies to gain real-time insights into their supply chains, facilitating better decision-making and risk assessment. The anticipated growth of the market from 7 USD Billion in 2024 to 20.3 USD Billion by 2035 suggests that businesses are investing in technologies that enhance their supply chain capabilities. This focus on resilience is likely to drive the adoption of procurement software, as organizations seek to build more agile and responsive supply chains.

Increased Demand for Automation

The Global Procurement Software Market Industry experiences a notable surge in demand for automation solutions. Organizations are increasingly recognizing the potential of procurement software to streamline processes, reduce manual errors, and enhance efficiency. As of 2024, the market is valued at approximately 7 USD Billion, reflecting a growing inclination towards automated procurement processes. This trend is likely to continue as companies seek to optimize their supply chains and improve operational performance. The integration of artificial intelligence and machine learning into procurement software further enhances its capabilities, allowing for predictive analytics and better decision-making. Consequently, the demand for automation in procurement is a significant driver of market growth.

Integration of Advanced Technologies

The integration of advanced technologies is a key driver in the Global Procurement Software Market Industry. The incorporation of artificial intelligence, machine learning, and data analytics into procurement software enhances its functionality and effectiveness. These technologies enable organizations to automate repetitive tasks, analyze vast amounts of data, and derive actionable insights. As the market is projected to grow at a CAGR of 10.18% from 2025 to 2035, the adoption of advanced technologies in procurement processes is expected to accelerate. This trend not only improves operational efficiency but also empowers organizations to make informed decisions, ultimately driving the demand for procurement software.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are increasingly influencing the Global Procurement Software Market Industry. Organizations face stringent regulations regarding procurement practices, necessitating robust software solutions to ensure compliance. Procurement software aids in tracking supplier performance, managing contracts, and maintaining audit trails, which are essential for meeting regulatory requirements. The growing emphasis on transparency and accountability in procurement processes further underscores the importance of these solutions. As businesses navigate complex regulatory landscapes, the demand for procurement software that facilitates compliance and mitigates risks is expected to rise, contributing to the overall market growth.