Market Trends

Key Emerging Trends in the Procurement Software Market

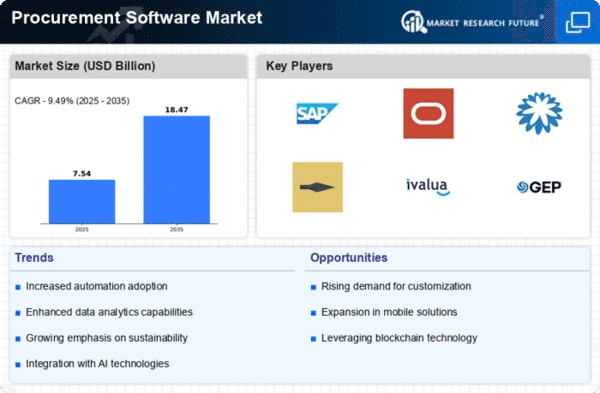

The procurement software market is experiencing notable trends that reflect the evolving needs and priorities of businesses across various industries. One prominent trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) into procurement solutions. These technologies are transforming traditional procurement processes by enabling predictive analytics, automation of routine tasks, and the extraction of actionable insights from large datasets. As organizations recognize the potential for enhanced efficiency and informed decision-making, the demand for AI-driven procurement software continues to rise, marking a significant trend in the market.

Another noteworthy trend is the emphasis on sustainability and ethical sourcing within procurement practices. Businesses are becoming more conscious of their environmental and social responsibilities, leading to a growing interest in procurement software that supports sustainable and ethical sourcing strategies. This trend reflects a broader shift in consumer and corporate values, with organizations seeking solutions that help them track and manage the environmental and social impact of their supply chains. Procurement software vendors are responding to this trend by incorporating features that enable organizations to assess and monitor the sustainability credentials of their suppliers

Cloud-based solutions are gaining significant traction as a prevailing trend in the procurement software market. Cloud deployment offers increased flexibility, scalability, and accessibility, allowing organizations to streamline their procurement processes without the need for extensive on-premise infrastructure. This trend aligns with the broader shift towards cloud computing in the business landscape, as companies seek cost-effective and agile solutions that can adapt to changing requirements. The convenience of accessing procurement tools from any location with an internet connection further contributes to the popularity of cloud-based procurement software.

Collaborative supplier relationships are emerging as a key trend within the procurement software market. Organizations are recognizing the strategic importance of building strong partnerships with their suppliers to foster innovation, reduce risks, and improve overall supply chain resilience. Procurement software that facilitates effective communication, collaboration, and information sharing between buyers and suppliers is gaining prominence. This trend reflects a departure from traditional transactional approaches to procurement, emphasizing the value of long-term, mutually beneficial relationships between businesses and their suppliers.

User-friendly interfaces and enhanced user experiences are becoming integral components of procurement software trends. As organizations seek to empower users across various departments to actively engage with procurement processes, vendors are investing in creating intuitive and accessible interfaces. The goal is to make the adoption and utilization of procurement software more user-friendly, even for non-expert users. This trend is driven by the recognition that widespread user acceptance and engagement are crucial for the successful implementation of procurement software within organizations.

The rise of mobile procurement is also shaping market trends, reflecting the increasing reliance on mobile devices in the business environment. Procurement software vendors are developing mobile-friendly applications that allow users to manage procurement activities on-the-go. This trend aligns with the demand for greater flexibility and responsiveness in today's fast-paced business landscape, enabling users to access critical procurement information and perform tasks from their mobile devices.

Leave a Comment