Major market players are spending a lot of money on R&D to increase their product lines, which will help the Polyvinylidene Fluoride Market (PVDF) market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Polyvinylidene Fluoride Market (PVDF) industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

The major market players are investing a lot of money in R&D to expand their product lines, which will spur further market growth for Polyvinylidene Fluoride Market (PVDF). With significant market development like new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic activities to expand their presence. To grow and thrive in a market climate that is becoming more competitive and growing, competitors in the Polyvinylidene Fluoride Market (PVDF) industry must offer affordable products.

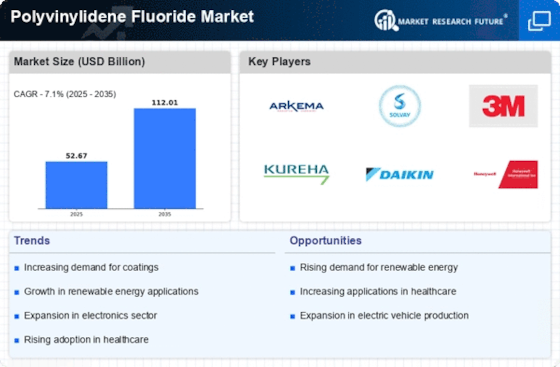

Manufacturing locally to cut operating costs is one of the main business tactics manufacturers use in the Polyvinylidene Fluoride Market (PVDF) industry to benefit customers and expand the market sector. Major Polyvinylidene Fluoride Market (PVDF) market players, including 3M, Arkema, Daikin Industries, Ltd, Solvay S.A, Shanghai Sanai Fu New Material Co., Ltd., Kureha Corporation, Ofluorine Chemical Technology Co., Ltd., Zhejiang Fotech International Co., Ltd., Zhuzhou Hongda Polymer Materials Co., Ltd., and the Quadrant group of companies, and others, are attempting to increase market demand by funding R&D initiatives.

3M is a multinational conglomerate corporation. The company produces a wide range of products across various sectors, including industrial, safety, graphics, healthcare, electronics, energy, and consumer goods. The company is known for its innovative products and technologies, including Post-it Notes, Scotch Tape, and N95 respirators, among others. Some of the key business units of 3M include industrial, safety and graphics, healthcare, and electronics and energy.

Arkema is a French multinational chemical company that specializes in the production of specialty chemicals and advanced materials. The company operates in three main business segments: high-performance materials, industrial specialties, and coating solutions. Arkema's products are used in a wide range of industries, including automotive, aerospace, construction, electronics, and renewable energy, among others. Some of the key products manufactured by Arkema include polymer resins, fluorinated products, adhesives, and coatings.