Aluminum Fluoride Market Summary

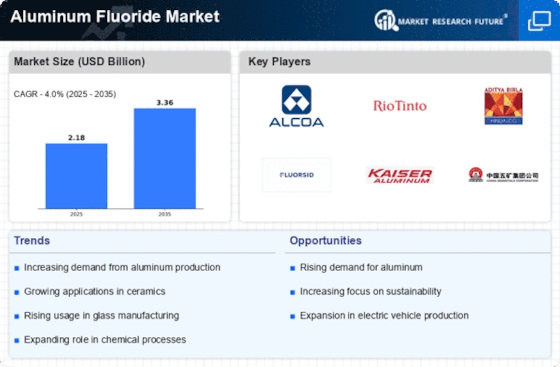

As per Market Research Future analysis, the Aluminum Fluoride Market Size was estimated at 2.184 USD Billion in 2024. The Aluminum Fluoride industry is projected to grow from 2.271 USD Billion in 2025 to 3.362 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Aluminum Fluoride Market is poised for growth driven by sustainability and technological advancements.

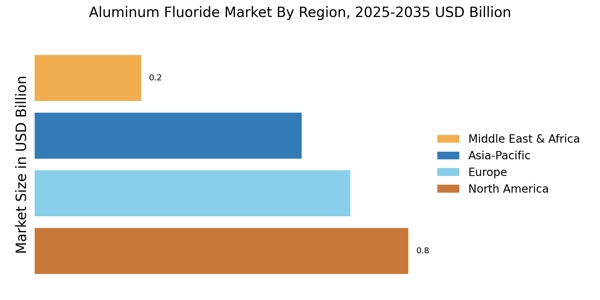

- North America remains the largest market for aluminum fluoride, driven by robust demand from the aluminum smelting industry.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing industrialization and urbanization.

- The dry segment continues to dominate the market, while the anhydrous segment is experiencing rapid growth due to its applications in specialty chemicals.

- Key market drivers include rising demand from aluminum smelting and regulatory support for aluminum production, which are shaping market dynamics.

Market Size & Forecast

| 2024 Market Size | 2.184 (USD Billion) |

| 2035 Market Size | 3.362 (USD Billion) |

| CAGR (2025 - 2035) | 4.0% |

Major Players

Alcoa Corporation (US), Rio Tinto Group (GB), Hindalco Industries Limited (IN), Fluorsid S.p.A. (IT), Kaiser Aluminum Corporation (US), China Minmetals Corporation (CN), Norsk Hydro ASA (NO), Mitsubishi Aluminum Co., Ltd. (JP)