Market Growth Projections

The Global Calcium Fluoride Market Industry is projected to experience substantial growth, with estimates indicating a rise from 1.07 USD Billion in 2024 to 2.66 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 8.64% from 2025 to 2035, driven by increasing applications across various sectors, including metallurgy, chemicals, and glass manufacturing. The expanding industrial base and the rising demand for high-performance materials are likely to fuel this growth. As industries continue to innovate and seek efficient solutions, calcium fluoride is expected to play a pivotal role in meeting these evolving needs.

Expansion of the Chemical Industry

The Global Calcium Fluoride Market Industry is significantly influenced by the expansion of the chemical sector, where calcium fluoride is utilized in the production of various chemicals, including hydrofluoric acid. This chemical is essential for manufacturing fluoropolymers and refrigerants, which are increasingly in demand due to their applications in diverse industries. The projected growth of the chemical industry, coupled with the rising need for fluorinated compounds, suggests a favorable outlook for calcium fluoride consumption. By 2035, the market is anticipated to grow to 2.66 USD Billion, driven by the chemical sector's expansion and innovation in fluorine chemistry.

Emerging Markets and Industrialization

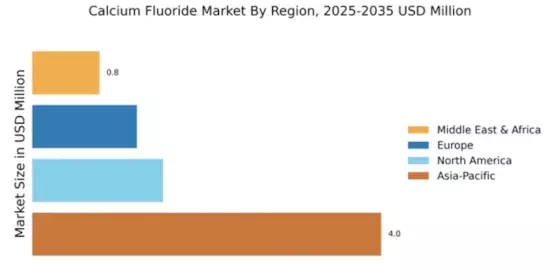

The Global Calcium Fluoride Market Industry is poised for growth due to the industrialization of emerging markets, particularly in Asia-Pacific and Latin America. These regions are witnessing rapid urbanization and infrastructure development, driving the demand for calcium fluoride in various applications, including metallurgy and chemicals. As these economies expand, the need for high-quality materials, including calcium fluoride, is likely to increase. This trend suggests a promising future for the market, as emerging economies contribute significantly to the overall growth, potentially enhancing the global market landscape.

Growth in the Glass and Ceramics Sector

The Global Calcium Fluoride Market Industry benefits from the growth in the glass and ceramics sector, where calcium fluoride is employed as a flux to lower melting temperatures and enhance the quality of glass products. The increasing demand for high-quality glass in construction, automotive, and consumer goods sectors is likely to propel the market forward. Additionally, the ceramics industry utilizes calcium fluoride to improve the mechanical properties of ceramic materials. This dual application in both glass and ceramics positions calcium fluoride as a critical component, contributing to the market's projected compound annual growth rate of 8.64% from 2025 to 2035.

Regulatory Support for Fluorine Compounds

The Global Calcium Fluoride Market Industry is positively impacted by regulatory support for the use of fluorine compounds in various applications. Governments worldwide are increasingly recognizing the benefits of fluorinated materials in enhancing product performance and sustainability. This regulatory environment encourages innovation and investment in calcium fluoride production and utilization. As industries seek to comply with environmental standards while maintaining product efficacy, the demand for calcium fluoride is expected to rise. This trend may lead to a more robust market presence, aligning with the projected growth trajectory of the industry in the coming years.

Increasing Demand in Metallurgical Applications

The Global Calcium Fluoride Market Industry experiences a notable surge in demand due to its extensive applications in metallurgy, particularly in steel and aluminum production. Calcium fluoride serves as a fluxing agent, enhancing the fluidity of molten metals and reducing impurities. This trend is likely to be driven by the growing industrial activities and infrastructure development globally. As a result, the market is projected to reach 1.07 USD Billion in 2024, reflecting the increasing reliance on calcium fluoride in metallurgical processes. The robust growth in the metallurgical sector underscores the importance of calcium fluoride in achieving higher efficiency and quality in metal production.