Regulatory Compliance

Regulatory frameworks are increasingly influencing the Polyurethane Dispersion Market, as manufacturers strive to comply with stringent environmental and safety standards. Governments worldwide are implementing regulations aimed at reducing volatile organic compounds (VOCs) in industrial products, which has led to a shift towards low-VOC and zero-VOC polyurethane dispersions. This regulatory push is compelling manufacturers to innovate and reformulate their products to meet compliance requirements. As a result, the market is witnessing a surge in the development of compliant products that not only meet regulatory standards but also appeal to health-conscious consumers. Industry expert's indicate that adherence to these regulations could enhance market competitiveness and open new avenues for growth.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Polyurethane Dispersion Market. Innovations in formulation chemistry and production processes are leading to the development of high-performance polyurethane dispersions that offer superior properties such as enhanced durability, flexibility, and adhesion. These advancements are particularly beneficial in applications such as coatings, adhesives, and sealants, where performance is critical. Furthermore, the integration of automation and digital technologies in manufacturing processes is streamlining production, reducing costs, and improving product consistency. Market data indicates that the adoption of advanced manufacturing technologies could potentially increase production efficiency by up to 20%, thereby fostering growth in the Polyurethane Dispersion Market.

Sustainability Initiatives

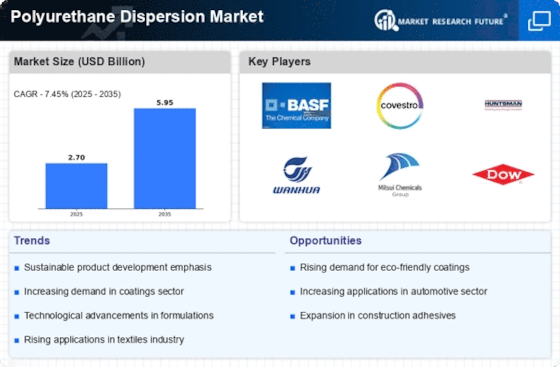

The increasing emphasis on sustainability within the Polyurethane Dispersion Market is driving demand for eco-friendly products. Manufacturers are increasingly adopting water-based polyurethane dispersions, which are less harmful to the environment compared to solvent-based alternatives. This shift aligns with regulatory pressures and consumer preferences for sustainable materials. As a result, the market is witnessing a notable rise in the production of bio-based polyurethanes, which are derived from renewable resources. According to recent data, the market for bio-based polyurethanes is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend not only enhances the market's appeal but also positions it favorably in the eyes of environmentally conscious consumers.

Diverse End-Use Applications

The versatility of polyurethane dispersions is a significant driver for the Polyurethane Dispersion Market. These materials find applications across various sectors, including automotive, construction, textiles, and consumer goods. In the automotive sector, for instance, polyurethane dispersions are utilized in coatings and adhesives, enhancing vehicle aesthetics and performance. The construction industry employs these dispersions for waterproofing and insulation applications, contributing to energy efficiency. Recent market analysis suggests that the construction segment alone accounts for nearly 30% of the total demand for polyurethane dispersions. This broad range of applications not only diversifies the market but also mitigates risks associated with reliance on a single sector, thereby promoting stability and growth.

Rising Demand in Emerging Economies

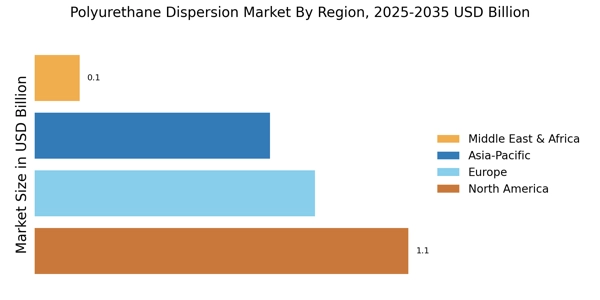

Emerging economies are exhibiting a growing demand for polyurethane dispersions, significantly impacting the Polyurethane Dispersion Market. As these regions experience rapid industrialization and urbanization, the need for advanced materials in construction, automotive, and consumer goods is escalating. Countries in Asia and Latin America are particularly noteworthy, as they are investing heavily in infrastructure development and manufacturing capabilities. This trend is expected to drive the consumption of polyurethane dispersions, with market forecasts suggesting a potential increase in demand by over 15% in these regions over the next five years. The expansion of the middle class in these economies further fuels the demand for high-quality consumer products, thereby enhancing the market's growth prospects.