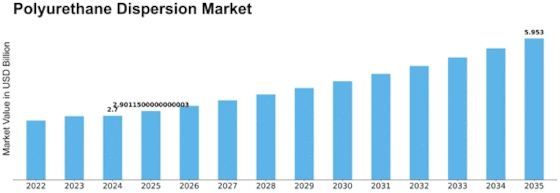

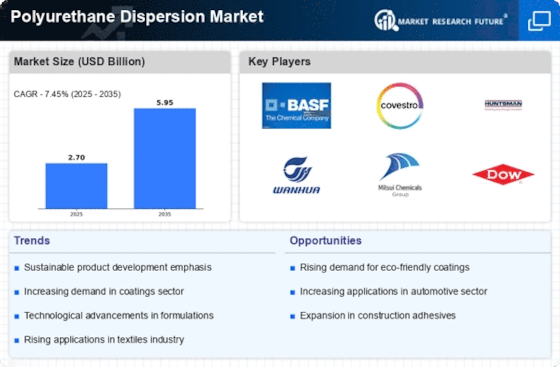

Polyurethane Dispersion Size

Polyurethane Dispersion Market Growth Projections and Opportunities

The Polyurethane Dispersion Market is influenced by various market factors, contributing to its growth and dynamics:

Growing Demand in End-Use Industries: The demand for polyurethane dispersions is driven by their wide-ranging applications across diverse end-use industries such as coatings, adhesives, sealants, textiles, and leather finishing. Industries rely on polyurethane dispersions for their versatility, durability, and performance-enhancing properties, fueling the market's growth.

Shift towards Water-Based Formulations: There is a notable shift towards water-based formulations in various industries due to environmental regulations and increasing awareness of sustainability. Polyurethane dispersions offer a viable alternative to solvent-based coatings and adhesives, as they are water-based, low in VOCs (volatile organic compounds), and environmentally friendly, driving their adoption in the market.

Demand for High-Performance Coatings: The construction, automotive, and industrial sectors require high-performance coatings that offer durability, weather resistance, and corrosion protection. Polyurethane dispersions provide these characteristics, making them suitable for applications such as architectural coatings, automotive refinishing, and industrial coatings, driving their demand in the market.

Advancements in Material Science: Continuous advancements in material science and polymer chemistry lead to the development of innovative polyurethane dispersion formulations with enhanced properties and functionalities. Manufacturers invest in research and development to introduce products with improved adhesion, flexibility, chemical resistance, and UV stability, catering to evolving industry needs and driving market growth.

Growth in Construction Activities: The booming construction industry, particularly in emerging economies, drives the demand for polyurethane dispersions in applications such as wood coatings, concrete sealers, and waterproofing membranes. As construction activities increase, so does the demand for high-performance coatings and sealants, contributing to the market's growth.

Automotive Sector Expansion: The automotive industry is a significant consumer of polyurethane dispersions for automotive coatings, adhesives, and sealants. With the expansion of the automotive sector, driven by factors such as rising vehicle production, increasing consumer demand for high-quality finishes, and advancements in automotive technology, the demand for polyurethane dispersions is expected to grow in the market.

Textile and Leather Finishing Applications: Polyurethane dispersions are widely used in textile and leather finishing applications due to their soft feel, durability, and resistance to abrasion. The textile and leather industries utilize polyurethane dispersions for applications such as synthetic leather, upholstery fabrics, footwear, and fashion accessories, driving their demand in the market.

Focus on Performance and Sustainability: Industries increasingly prioritize performance, sustainability, and regulatory compliance when selecting coating and adhesive solutions. Polyurethane dispersions offer a balance of performance and sustainability, meeting stringent regulatory standards while providing excellent adhesion, durability, and environmental compatibility, driving their adoption in the market.

Regulatory Environment and Standards: Stringent regulations regarding VOC emissions, hazardous chemicals, and product safety influence the selection and use of coating and adhesive materials. Polyurethane dispersions comply with regulatory standards such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and are preferred for their low VOC content and eco-friendly attributes, driving their demand in the market.

Global Market Trends: Global market trends, including economic developments, geopolitical factors, and shifting consumer preferences, also influence the demand for polyurethane dispersions. Manufacturers monitor global market dynamics to identify emerging opportunities and adjust their strategies to meet changing market demands effectively, driving market growth and innovation in the polyurethane dispersion sector.

Leave a Comment