Consumer Preferences

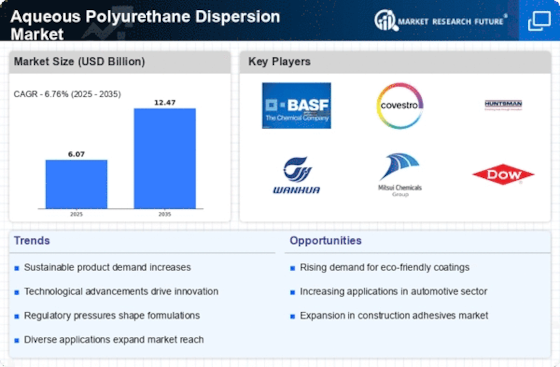

Shifting consumer preferences towards environmentally friendly and high-performance products are driving the Aqueous Polyurethane Dispersion Market. As consumers become more aware of the environmental impact of their choices, there is a growing demand for products that are both effective and sustainable. Aqueous polyurethane dispersions meet these criteria, offering a balance of performance and eco-friendliness. This trend is particularly pronounced in sectors such as automotive and construction, where consumers are increasingly seeking materials that contribute to energy efficiency and sustainability. Market forecasts indicate that by 2025, the influence of consumer preferences will significantly shape the market landscape, as manufacturers adapt their offerings to align with the values and expectations of their customers.

Regulatory Compliance

Regulatory frameworks aimed at reducing environmental impact are increasingly influencing the Aqueous Polyurethane Dispersion Market. Governments worldwide are implementing stringent regulations regarding the use of hazardous substances, particularly in the coatings and adhesives sectors. Aqueous polyurethane dispersions, with their low VOC content, are well-positioned to comply with these regulations, making them an attractive choice for manufacturers. As companies seek to align with regulatory standards, the demand for aqueous polyurethane dispersions is expected to rise. This trend is particularly evident in regions where environmental regulations are becoming more stringent. By 2025, the market is likely to benefit from this regulatory push, as businesses prioritize compliance and sustainability in their operations.

Diverse Application Areas

The versatility of aqueous polyurethane dispersions is a significant driver for the Aqueous Polyurethane Dispersion Market. These materials find applications across various sectors, including coatings, adhesives, textiles, and automotive. The ability to tailor the properties of aqueous polyurethane dispersions to meet specific requirements makes them suitable for a wide range of uses. For instance, in the coatings industry, they are utilized for their excellent adhesion and weather resistance. In the textile sector, they provide durability and flexibility, enhancing the performance of fabrics. As industries continue to explore new applications, the demand for aqueous polyurethane dispersions is likely to increase. Market analysts project that by 2025, the expansion of application areas will contribute to a notable increase in market size, reflecting the growing recognition of these materials' benefits.

Technological Innovations

Technological advancements play a crucial role in shaping the Aqueous Polyurethane Dispersion Market. Innovations in formulation and production processes have led to the development of high-performance aqueous polyurethane dispersions that offer superior properties such as enhanced durability, flexibility, and adhesion. In recent years, the introduction of advanced manufacturing techniques has enabled the production of these dispersions at a lower cost, making them more accessible to a wider range of applications. The market is expected to expand as manufacturers invest in research and development to create innovative products that meet the evolving needs of end-users. By 2025, the market is anticipated to grow significantly, driven by the continuous evolution of technology and the increasing demand for high-quality, efficient materials.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the Aqueous Polyurethane Dispersion Market. As industries strive to reduce their environmental footprint, the demand for eco-friendly materials has surged. Aqueous polyurethane dispersions, known for their low volatile organic compound (VOC) emissions, align well with these sustainability goals. In 2025, the market is projected to witness a growth rate of approximately 6% annually, driven by the rising adoption of green technologies across various sectors, including automotive, textiles, and construction. Companies are increasingly seeking alternatives to solvent-based products, which further propels the demand for aqueous polyurethane dispersions. This shift not only meets regulatory requirements but also caters to consumer preferences for sustainable products, thereby enhancing the market's growth potential.