Market Analysis

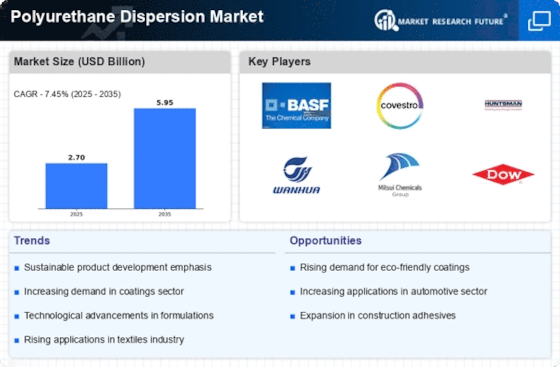

In-depth Analysis of Polyurethane Dispersion Market Industry Landscape

The Polyurethane Dispersion (PUD) market is influenced by various market dynamics, shaping its growth trajectory and competitive landscape:

Increasing Demand from End-Use Industries: Market dynamics are heavily influenced by the growing demand for Polyurethane Dispersions across diverse end-use industries such as coatings, adhesives, sealants, textiles, and leather. The versatility of PUDs makes them suitable for a wide range of applications, driving their demand in industries seeking high-performance and environmentally friendly materials.

Stringent Environmental Regulations: The market dynamics of Polyurethane Dispersions are significantly impacted by environmental regulations governing volatile organic compounds (VOCs) and hazardous chemicals. PUDs offer a low VOC content and are water-based, making them compliant with regulatory standards and appealing to industries seeking eco-friendly solutions, thereby driving market growth.

Shift towards Water-Based Formulations: Market dynamics are shaped by the ongoing shift towards water-based formulations in various industries, driven by environmental concerns and regulatory compliance. Polyurethane Dispersions offer water-based alternatives to solvent-based coatings and adhesives, meeting the demand for sustainable and environmentally friendly materials in the market.

Advancements in Formulation Technology: Continuous advancements in formulation technology drive innovation in Polyurethane Dispersions, leading to the development of products with improved performance characteristics such as durability, adhesion, flexibility, and weather resistance. Manufacturers invest in research and development to introduce innovative PUD formulations that address evolving industry needs, driving market growth and competitiveness.

Growing Construction Industry: The construction industry is a major consumer of Polyurethane Dispersions for applications such as architectural coatings, sealants, and adhesives. Market dynamics are influenced by the growth of the construction sector, driven by infrastructure development, urbanization, and renovation projects, which increase the demand for high-performance coatings and adhesives in the market.

Expansion of Automotive Sector: The automotive industry utilizes Polyurethane Dispersions in applications such as automotive coatings, sealants, and adhesives for interior and exterior components. Market dynamics are shaped by the expansion of the automotive sector, driven by factors such as consumer demand, technological advancements, and regulatory requirements, contributing to the demand for PUDs in the market.

Focus on Performance and Durability: Market dynamics are influenced by the growing emphasis on performance and durability in coatings, adhesives, and sealants. Polyurethane Dispersions offer excellent adhesion, abrasion resistance, chemical resistance, and weatherability, making them preferred choices for applications requiring long-term performance and durability in harsh environments.

Market Consolidation and Mergers: The competitive landscape of the Polyurethane Dispersion market is shaped by market consolidation and mergers among key players. Market dynamics are influenced by mergers, acquisitions, and strategic alliances, which lead to the consolidation of market share and the expansion of product portfolios, driving competition and market growth.

Regional Market Trends: Market dynamics vary regionally based on factors such as economic conditions, industrial growth, and regulatory frameworks. Regional market trends influence the demand for Polyurethane Dispersions, with emerging economies experiencing rapid industrialization and infrastructure development driving market growth in those regions.

Emerging Applications and Opportunities: Market dynamics are driven by emerging applications and opportunities for Polyurethane Dispersions in industries such as packaging, furniture, textiles, and electronics. Market growth is fueled by the development of innovative PUD formulations tailored to specific application requirements and the exploration of new market segments, driving diversification and expansion in the Polyurethane Dispersion market.

Leave a Comment