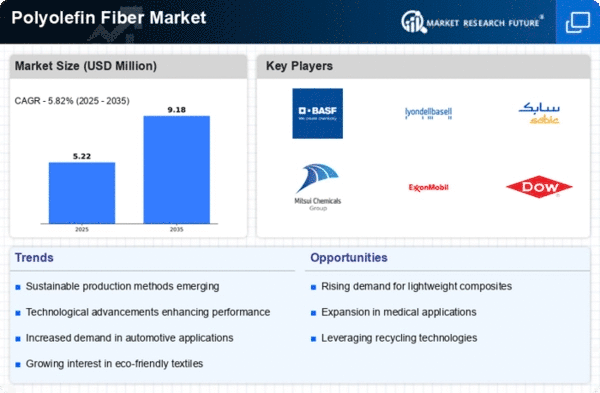

Top Industry Leaders in the Polyolefin Fiber Market

Polyolefin Fiber Market

The polyolefin fiber market, encompassing polypropylene (PP) and polyethylene (PE) fibers, presents a dynamic and vibrant arena with significant growth potential. Its diverse applications, spanning textiles, hygiene products, filtration systems, and automotive components, fuel a competitive landscape teeming with established players and innovative upstarts. To navigate this multifaceted market, let's delve into its key strategies, market share determinants, recent news, and developments.

Strategies Shaping the Game:

-

Product Diversification: Leading players like ExxonMobil, Reliance Industries, and Formosa Plastics are expanding their portfolios beyond staple fibers, venturing into functional fibers with enhanced UV resistance, flame retardancy, and antibacterial properties. This caters to specific end-use demands and unlocks premium market segments. -

Sustainability Focus: Sustainability, a rising tide in all industries, is influencing strategies. Bio-based polyolefin fibers derived from corn or sugarcane are gaining traction, driven by eco-conscious consumers and stringent regulations. Companies like DuPont and Unifi are actively investing in bio-based fiber production to tap into this emerging market. -

Regional Expansion: Asia-Pacific currently dominates the polyolefin fiber market, but players are eyeing opportunities in developing regions like Latin America and Africa. Investing in local production facilities and distribution networks helps them overcome logistical challenges and cater to regional preferences. -

Vertical Integration: Integrating upstream with feedstock production and downstream with textile manufacturing offers cost advantages and control over the entire value chain. Companies like Reliance Industries and Jindal Poly have adopted this strategy to secure raw materials and enhance profitability. -

Technological Innovation: Continuous research and development lead to improved fiber properties, production processes, and recycling technologies. For instance, advances in melt-blown nonwoven technology are driving innovation in hygiene products. Technological prowess is a key differentiator in the market.

Factors Determining Market Share:

-

Production Capacity and Cost Efficiency: Large-scale production facilities and efficient manufacturing processes translate to lower production costs and a competitive edge. Players like ExxonMobil and Reliance Industries leverage their economies of scale to secure significant market share. -

Product Quality and Innovation: Delivering consistent high-quality fibers and actively innovating to meet evolving customer needs are crucial for market share dominance. Companies like Trevira and ES FiberVisions excel in developing specialty fibers, catering to niche applications. -

Brand Reputation and Customer Relationships: Building a strong brand image and fostering long-term partnerships with customers solidify market position. Established players like 3M and DuPont, recognized for their quality and reliability, command significant customer loyalty. -

Geographical Presence and Distribution Network: A robust global presence and efficient distribution networks ensure timely product delivery and market reach. Companies like Formosa Plastics and Welspun India, with extensive distribution networks, cater to diverse regional demands. -

Regulatory Compliance and Sustainability Initiatives: Adherence to environmental regulations and proactive sustainability efforts resonate with customers and investors, enhancing brand image and market share. Companies like Unifi and Freudenberg are recognized for their sustainability leadership.

List of Key Players in the Polyolefin Fiber Market:

- 3M (U.S.),

- ES FiberVisions (Thailand),

- Trevira GmbH (Germany),

- Bauder Ltd (UK),

- Dorken GmbH & Co.KG (Germany),

- Polyglass (U.S.),

- Alpek S.A.B. de C.V (Mexico),

- Biobent Polymers (U.S.),

- Durafiber (U.S.),

- Honeywell International Inc. (U.S.),

- Welspun India Ltd (India),

- Beijing Tongyizhong Speciality Fiber Technology & Development Co., Ltd (China),

- Anhui Elite Industrial Co., Ltd (China)

Recent Developments:

August 2023: Honeywell introduces a new meltblown nonwoven fabric made from recycled polyolefin fibers, targeting the hygiene and filtration markets with a sustainable offering.

September 2023: Welspun India announces a partnership with a leading medical textile manufacturer to develop surgical gowns made from high-performance polyolefin fibers, aiming to improve patient safety.

October 2023: Reliance Industries expands its polypropylene production capacity in India, anticipating a surge in demand for polyolefin fibers in the domestic market.

November 2023: DuPont collaborates with a startup company to develop a bio-based dyeing process for polyolefin fibers, addressing concerns about the environmental impact of traditional dyeing methods.

December 2023: The International Textile Manufacturers Federation releases a report highlighting the potential of polyolefin fibers in geotextiles for soil erosion control and infrastructure reinforcement, opening new avenues for market growth.