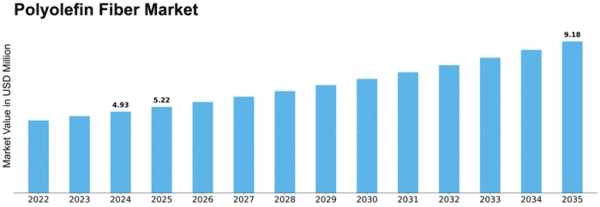

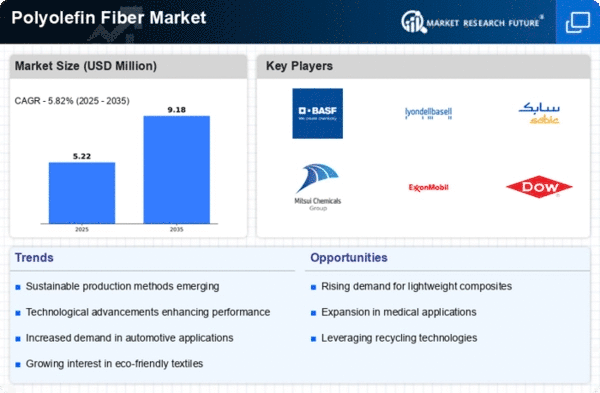

Polyolefin Fiber Size

Polyolefin Fiber Market Growth Projections and Opportunities

The polyolefin fiber market is influenced by a variety of market factors that shape its dynamics and growth trajectory. Polyolefin fibers are synthetic fibers made from polymers of olefins such as polyethylene and polypropylene. These fibers are widely used in various applications including textiles, packaging, automotive, and construction industries. Understanding the market factors driving the demand and supply of polyolefin fibers is crucial for stakeholders to make informed decisions.

Polyolefin fibers are synthetic fibers, widely used in the manufacturing of carpets and rugs due to high tensile strength, abrasion resistance, and inertness. These fibers are classified into two types namely polypropylene (PP) and polyethylene (PE) with PP being the preferred choice in textile applications.

One of the key market factors affecting the polyolefin fiber market is the demand from end-use industries. The textile industry is a major consumer of polyolefin fibers, where these fibers are used in the production of non-woven fabrics, geotextiles, and other technical textiles. The growth of the global textile industry, driven by factors such as population growth, rising disposable income, and changing fashion trends, directly impacts the demand for polyolefin fibers. Similarly, the packaging industry, which uses polyolefin fibers for applications such as flexible packaging and wrapping materials, also contributes significantly to the demand for these fibers.

Another important market factor is the availability and price of raw materials. Polyolefin fibers are derived from petrochemical feedstocks such as ethylene and propylene, which are subject to price fluctuations influenced by factors such as crude oil prices, supply-demand dynamics, and geopolitical events. Any disruption in the supply of raw materials or significant changes in their prices can impact the production cost of polyolefin fibers, thereby affecting their market dynamics.

Technological advancements also play a significant role in shaping the polyolefin fiber market. Innovations in polymer chemistry, fiber spinning techniques, and manufacturing processes contribute to the development of new and improved polyolefin fibers with enhanced properties such as strength, durability, and flame retardancy. These technological advancements not only drive product innovation but also improve manufacturing efficiency and reduce production costs, making polyolefin fibers more competitive in the market.

Environmental and regulatory factors are becoming increasingly important in the polyolefin fiber market. With growing concerns over plastic pollution and environmental sustainability, there is a growing demand for eco-friendly and recyclable fibers. Polyolefin fibers, being thermoplastic polymers, are recyclable and can be reused in various applications. As a result, there is a rising trend towards the use of recycled polyolefin fibers in industries such as textiles and packaging. Furthermore, governments and regulatory bodies are implementing policies and regulations aimed at reducing the use of single-use plastics and promoting the adoption of sustainable alternatives, which could impact the demand for polyolefin fibers.

Market competition and industry structure also influence the dynamics of the polyolefin fiber market. The market is characterized by a few major players dominating the industry, along with numerous small and medium-sized manufacturers catering to niche markets and applications. Intense competition among players leads to pricing pressures and innovation in product offerings to differentiate from competitors. Additionally, factors such as mergers and acquisitions, strategic partnerships, and geographic expansion strategies adopted by key players can influence market dynamics and competitive landscape.

Lastly, macroeconomic factors such as economic growth, consumer spending patterns, and demographic trends also impact the demand for polyolefin fibers. Economic downturns or recessions can lead to a decrease in consumer demand for goods such as textiles and packaged products, thereby affecting the demand for polyolefin fibers. Conversely, economic prosperity and rising consumer purchasing power can boost demand for polyolefin fibers as they are essential components in various consumer products.

Leave a Comment