Market Trends

Key Emerging Trends in the Polyolefin Fiber Market

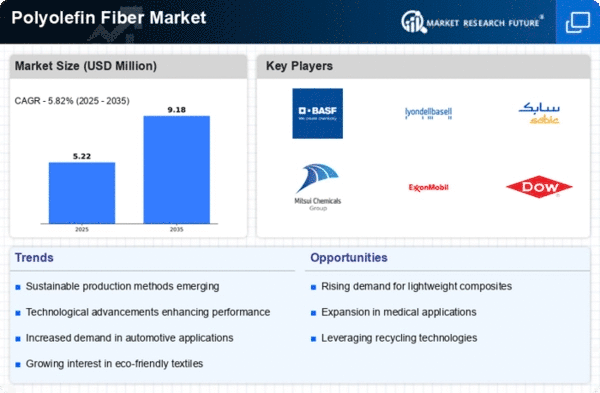

The polyolefin fiber market has been witnessing significant trends and developments in recent years. Polyolefin fibers, which are derived from polymers such as polyethylene and polypropylene, have gained popularity due to their versatility, durability, and cost-effectiveness. One of the key trends in the market is the increasing demand for polyolefin fibers in various end-use industries such as textiles, automotive, construction, and packaging.

Changing fashion trends and high disposable income is driving the market growth of apparel industry across the globe. Growing use in automotive industry as a result of lightweight which enhances the fuel efficiency is fuelling the product demand across the globe.

In the textile industry, polyolefin fibers are being increasingly used in the manufacturing of non-woven fabrics, geotextiles, and carpet backing due to their high strength, moisture resistance, and chemical inertness. These fibers are also being used in the production of technical textiles for applications such as filtration, reinforcement, and protective clothing. The growing demand for technical textiles in sectors such as healthcare, agriculture, and industrial applications is expected to drive the market for polyolefin fibers in the textile industry.

In the automotive sector, there is a rising demand for lightweight materials that can help improve fuel efficiency and reduce emissions. Polyolefin fibers are being used in the production of lightweight composites for interior components such as door panels, seat backs, and trunk liners. These fibers offer excellent strength-to-weight ratio and can help reduce the overall weight of vehicles without compromising on performance or safety. As automotive manufacturers continue to focus on lightweighting strategies, the demand for polyolefin fibers is expected to grow further.

In the construction industry, polyolefin fibers are being used in a wide range of applications such as concrete reinforcement, insulation, and roofing materials. These fibers help improve the strength, durability, and crack resistance of concrete structures, thereby extending their lifespan and reducing maintenance costs. Additionally, polyolefin fibers are being used as a sustainable alternative to traditional materials such as steel and glass fibers, as they are recyclable and energy-efficient.

Another significant trend in the polyolefin fiber market is the increasing focus on sustainability and eco-friendly products. Polyolefin fibers are inherently recyclable and can be used to produce environmentally friendly products such as recycled polyester yarns and bio-based plastics. With growing awareness about the environmental impact of traditional materials, there is a rising demand for sustainable alternatives, which bodes well for the market growth of polyolefin fibers.

Furthermore, technological advancements and innovations in the field of polymer science are driving the development of new grades and formulations of polyolefin fibers with enhanced properties such as flame retardancy, UV resistance, and antimicrobial properties. These innovations are expanding the potential applications of polyolefin fibers in sectors such as healthcare, agriculture, and consumer goods.

Leave a Comment