Sustainability Initiatives

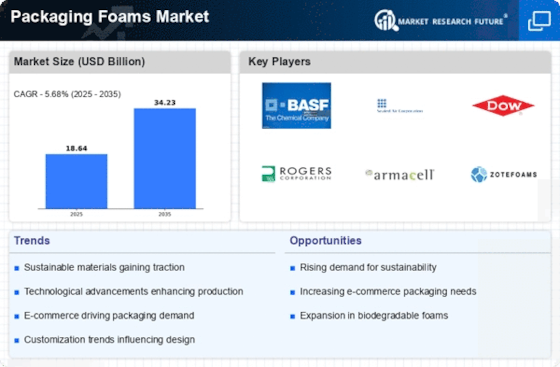

Sustainability initiatives are becoming increasingly pivotal in the Packaging Foams Market. As consumers and businesses alike prioritize eco-friendly practices, the demand for sustainable packaging solutions is on the rise. In 2025, the market for sustainable packaging is projected to reach 400 billion USD, with packaging foams playing a vital role in this transition. Manufacturers are exploring biodegradable and recyclable foam materials to meet consumer expectations and regulatory requirements. This shift towards sustainability not only addresses environmental concerns but also opens new avenues for innovation within the Packaging Foams Market. Companies that successfully integrate sustainable practices into their operations are likely to gain a competitive edge, appealing to a growing segment of environmentally conscious consumers.

Growth in Consumer Electronics

The Packaging Foams Market is significantly influenced by the growth in the consumer electronics sector. With the proliferation of smartphones, tablets, and other electronic devices, the need for effective packaging solutions has surged. In 2025, the consumer electronics market is expected to surpass 1 trillion USD, creating a substantial demand for packaging foams that can provide adequate protection against impacts and vibrations. Packaging foams are essential in ensuring that delicate electronic components remain intact during shipping and handling. Manufacturers are increasingly focusing on developing specialized foam materials that cater to the unique requirements of electronic products. This growth in consumer electronics not only drives the demand for packaging foams but also encourages innovation within the Packaging Foams Market, as companies strive to meet the evolving needs of their clients.

Rising Demand for Protective Packaging

The Packaging Foams Market experiences a notable increase in demand for protective packaging solutions. This trend is largely driven by the need to safeguard products during transit and storage. As e-commerce continues to expand, the requirement for effective cushioning materials becomes more pronounced. In 2025, the market for protective packaging is projected to reach approximately 30 billion USD, indicating a robust growth trajectory. Packaging foams, known for their lightweight and shock-absorbing properties, play a crucial role in ensuring product integrity. Companies are increasingly investing in innovative foam materials that enhance protection while minimizing weight, thereby reducing shipping costs. This rising demand for protective packaging solutions is likely to propel the Packaging Foams Market forward, as businesses seek to optimize their supply chains and improve customer satisfaction.

Regulatory Compliance and Safety Standards

The Packaging Foams Market is also shaped by stringent regulatory compliance and safety standards. As various industries, including food and pharmaceuticals, face increasing scrutiny regarding packaging materials, the demand for compliant packaging solutions rises. Regulations often dictate the use of specific materials that are safe for food contact or environmentally friendly. In 2025, it is anticipated that the market for compliant packaging solutions will grow significantly, with packaging foams being a key component. Companies are compelled to adapt their packaging strategies to meet these regulations, which may involve investing in new materials or processes. This focus on compliance not only enhances product safety but also fosters consumer trust, thereby driving growth within the Packaging Foams Market.

Technological Advancements in Foam Production

Technological advancements in foam production are significantly impacting the Packaging Foams Market. Innovations in manufacturing processes, such as the development of high-performance foams and the use of advanced materials, are enhancing the functionality and efficiency of packaging solutions. In 2025, the market for advanced packaging materials is expected to grow, driven by the need for lightweight, durable, and cost-effective solutions. These advancements allow manufacturers to produce foams that not only provide superior protection but also reduce material waste. As companies increasingly adopt these technologies, the Packaging Foams Market is likely to witness a transformation, characterized by improved product offerings and enhanced operational efficiencies. This focus on technological innovation may also lead to new applications for packaging foams across various sectors.