Top Industry Leaders in the Packaging Foams Market

Packaging Foams Market

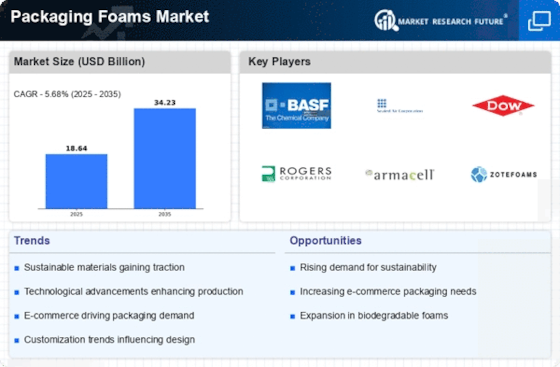

The packaging foams market, responsible for safeguarding products during transit and storage, is driven by the ever-expanding eCommerce sector, rising demand for food and beverage protection, and increasing focus on sustainability. But beneath the protective layers lies a fiercely competitive landscape where established players and nimble newcomers vie for market share.

Strategies Shaping the Foam Frontier:

-

Industry Titans: BASF, Dow Chemical, Sealed Air, and Sonoco leverage their extensive production capacities, diverse product portfolios, and global reach to maintain dominance. Their strategies focus on R&D for innovative foam materials, strategic acquisitions, and vertical integration across the supply chain. -

Regional Powerhouses: Regional players like Formosa Plastics in Asia and Knauf Insulation in Europe hold strong positions in their respective markets. They compete on price, cater to regional preferences, and build robust local distribution networks. -

Niche Specialists: Emerging players like Pregis Corporation and Armacell focus on specific niches like bio-based foams, temperature-controlled packaging, or anti-static solutions. They capitalize on unique capabilities and cater to specific customer segments, often at premium prices.

Factors Dictating Market Share:

-

Material Diversity and Performance: Offering a diverse range of foams like polystyrene (PS), polyurethane (PU), and polyethylene (PE) with various properties like cushioning, insulation, and moisture resistance attracts a wider customer base and increases market share. Continuous innovation for lightweight, sustainable, and high-performance options is crucial. -

Production Efficiency and Cost Optimization: Optimizing manufacturing processes, sourcing raw materials cost-effectively, and offering competitive pricing are crucial for gaining market share, particularly in price-sensitive sectors like food packaging. -

Sustainability and Environmental Regulations: Adhering to environmental regulations and developing eco-friendly foams like bio-based or recyclable solutions addresses environmental concerns and opens doors to new markets. -

Technology and Automation: Integrating automation and advanced technologies like advanced molding techniques and data analytics optimizes production, reduces waste, and enhances efficiency, leading to a competitive edge. -

Customer Service and Customization: Providing excellent customer service, technical support, and customization options builds trust and repeat business, leading to market share consolidation.

Key Players:

- JSP (Japan),

- Zotefoams PIc (U.K.),

- Armacell (Germany),

- Synthos SA (Poland),

- BASF SE (Germany),

- Sealed Air Corporation (U.S.),

- Rogers Corporation (U S.),

- Foampartner Group (Switzerland),

- Kaneka Corporation (Japan)

Recent Developments :

-

July 2023: BASF partners with a startup developing edible and biodegradable packaging foams, targeting the food and beverage industry. -

September 2023: Sonoco introduces a new line of anti-static foams for protecting sensitive electronic devices during shipping. -

October 2023: Formosa Plastics invests in a new production facility for high-performance PE foams, targeting the automotive and construction sectors. -

November 2023: Armacell collaborates with research institutions to develop bio-based foams using agricultural waste. -

December 2023: A consortium of packaging foam manufacturers and environmental NGOs launches a joint initiative to promote recycling and waste reduction in the industry.