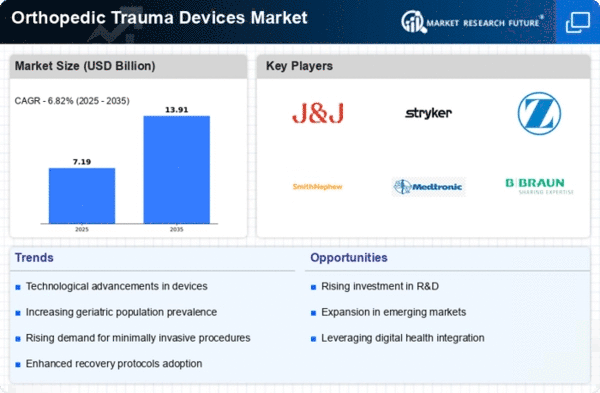

Market Growth Projections

The Global Orthopedic Trauma Devices Market Industry is projected to experience robust growth in the coming years. With an estimated market value of 6.73 USD Billion in 2024, the industry is anticipated to expand significantly, reaching 13.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.82% from 2025 to 2035. Such projections indicate a strong demand for orthopedic trauma devices driven by factors such as technological advancements, an aging population, and increasing healthcare expenditure. The market's expansion reflects the ongoing commitment to improving orthopedic care and addressing the needs of patients worldwide.

Growing Geriatric Population

The Global Orthopedic Trauma Devices Market Industry is significantly influenced by the growing geriatric population, which is more susceptible to fractures and orthopedic conditions. According to the United Nations, the number of individuals aged 65 and older is expected to double by 2050, leading to an increased demand for orthopedic trauma devices. This demographic shift necessitates the development of specialized devices tailored to the needs of older patients, such as hip and knee implants. As a result, the market is poised for growth, with a projected compound annual growth rate of 6.82% from 2025 to 2035, reflecting the urgent need for effective orthopedic solutions.

Rising Healthcare Expenditure

Rising healthcare expenditure globally is a crucial driver for the Global Orthopedic Trauma Devices Market Industry. As countries allocate more resources to healthcare, there is a corresponding increase in the availability and accessibility of advanced medical technologies, including orthopedic trauma devices. For instance, nations with robust healthcare systems are investing in innovative surgical techniques and rehabilitation programs, which enhance patient care. This trend is likely to stimulate market growth as healthcare providers seek to improve outcomes for patients with orthopedic injuries. The increasing focus on quality healthcare services is expected to contribute to the market's expansion in the foreseeable future.

Increase in Road Traffic Accidents

The Global Orthopedic Trauma Devices Market Industry is also driven by the alarming rise in road traffic accidents, which contribute significantly to orthopedic injuries. According to the World Health Organization, road traffic injuries claim approximately 1.35 million lives annually, with many survivors requiring orthopedic interventions. This trend underscores the need for advanced trauma devices to address the growing number of injuries sustained in accidents. As awareness of road safety increases and preventive measures are implemented, the demand for orthopedic trauma devices is expected to rise, further propelling market growth in the coming years.

Rising Incidence of Orthopedic Injuries

The Global Orthopedic Trauma Devices Market Industry experiences a notable surge in demand due to the increasing incidence of orthopedic injuries. Factors such as an aging population, active lifestyles, and rising participation in sports contribute to this trend. For instance, the World Health Organization indicates that musculoskeletal disorders are among the leading causes of disability worldwide. This growing prevalence of injuries necessitates advanced orthopedic trauma devices, which are projected to drive the market's growth significantly. The market is expected to reach 6.73 USD Billion in 2024, reflecting the urgent need for innovative solutions in orthopedic care.

Technological Advancements in Orthopedic Devices

Technological advancements play a pivotal role in shaping the Global Orthopedic Trauma Devices Market Industry. Innovations such as 3D printing, minimally invasive surgical techniques, and smart implants enhance the efficacy and safety of orthopedic procedures. These advancements not only improve patient outcomes but also reduce recovery times, thereby increasing the adoption of orthopedic trauma devices. As healthcare providers increasingly seek to integrate cutting-edge technology into their practices, the market is likely to witness substantial growth. By 2035, the market is projected to reach 13.9 USD Billion, underscoring the impact of technology on orthopedic trauma care.