Increased Healthcare Expenditure

The rising healthcare expenditure in the US is a significant driver for the trauma fixation-devices market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing emphasis on improving surgical outcomes and patient care. This increase in funding allows hospitals and healthcare facilities to invest in advanced trauma fixation devices, which are essential for effective treatment. Additionally, the shift towards value-based care models encourages healthcare providers to adopt innovative solutions that enhance patient recovery and reduce readmission rates. As a result, the trauma fixation-devices market is likely to benefit from this trend, with an expected growth rate of around 5% annually as healthcare systems prioritize quality and efficiency in trauma management.

Rising Incidence of Trauma Cases

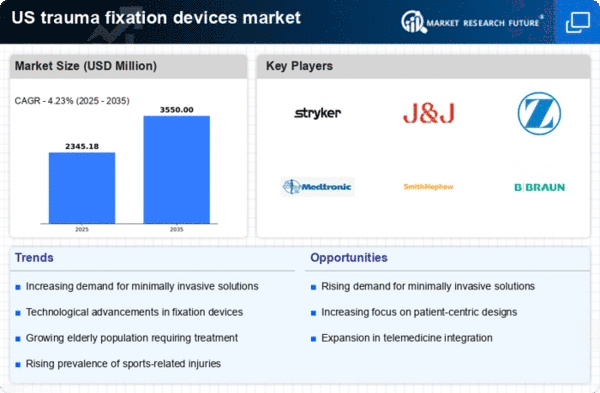

The increasing incidence of trauma cases in the US is a primary driver for the trauma fixation-devices market. Factors such as road accidents, sports injuries, and falls contribute significantly to this trend. According to the National Highway Traffic Safety Administration, there were over 38,000 fatalities in motor vehicle crashes in 2022 alone, highlighting the urgent need for effective trauma management solutions. This surge in trauma cases necessitates advanced fixation devices to ensure proper healing and recovery. As healthcare providers seek to improve patient outcomes, the demand for innovative trauma fixation devices is expected to rise, thereby propelling market growth. it is likely to experience a compound annual growth rate (CAGR) of approximately 6% over the next few years, driven by this increasing need for effective treatment options.

Supportive Reimbursement Policies

Supportive reimbursement policies are emerging as a key driver for the trauma fixation-devices market. Insurance providers are increasingly recognizing the importance of covering advanced fixation devices, which enhances patient access to necessary treatments. This trend is particularly evident in the context of orthopedic surgeries, where reimbursement for innovative devices is becoming more common. As healthcare policies evolve to support the use of advanced technologies, hospitals and clinics are more likely to invest in high-quality trauma fixation solutions. This shift in reimbursement practices is expected to stimulate market growth, with projections indicating a potential increase in the trauma fixation-devices market by 3% annually as more healthcare providers adopt these devices to meet patient needs.

Growing Awareness of Orthopedic Health

The growing awareness of orthopedic health among the US population is driving demand for trauma fixation devices. Educational campaigns and increased access to information have led to a better understanding of the importance of timely and effective treatment for traumatic injuries. Patients are now more proactive in seeking medical attention, which in turn increases the demand for advanced fixation solutions. Furthermore, the rise of telemedicine has facilitated consultations and follow-ups, making it easier for patients to access orthopedic care. This heightened awareness is expected to contribute to the growth of the trauma fixation-devices market, with estimates suggesting a potential increase in market size by approximately 4% over the next few years as more individuals seek treatment for their injuries.

Technological Innovations in Medical Devices

Technological innovations play a crucial role in shaping the trauma fixation-devices market. The introduction of advanced materials, such as bioresorbable polymers and titanium alloys, enhances the performance and safety of fixation devices. Furthermore, the integration of smart technologies, including sensors and monitoring systems, allows for real-time assessment of healing progress. These innovations not only improve patient outcomes but also reduce the risk of complications associated with traditional fixation methods. The trauma fixation-devices market is witnessing a shift towards minimally invasive techniques, which are associated with shorter recovery times and lower infection rates. As healthcare providers increasingly adopt these advanced technologies, the market is poised for substantial growth, with projections indicating a potential increase in market value by over $1 billion by 2027.