Increased Healthcare Expenditure

Rising healthcare expenditure in the US is a significant driver for the orthopedic trauma-devices market. As healthcare budgets expand, hospitals and surgical centers are more inclined to invest in advanced trauma devices that improve patient outcomes. The US healthcare spending is projected to reach approximately $4 trillion by 2025, with a substantial portion allocated to orthopedic care. This financial commitment facilitates the adoption of innovative devices and technologies, thereby enhancing the overall quality of care. Additionally, increased funding for research and development in orthopedic trauma solutions is likely to spur market growth, as new products are introduced to meet evolving patient needs.

Rising Incidence of Sports Injuries

The increasing participation in sports and physical activities in the US has led to a notable rise in sports-related injuries. This trend is particularly evident among younger populations, where injuries such as fractures and ligament tears are common. The orthopedic trauma-devices market is likely to benefit from this surge, as athletes often require advanced surgical interventions and rehabilitation devices. According to recent data, sports injuries account for approximately 20% of all orthopedic injuries, indicating a substantial demand for trauma devices. As awareness of injury prevention and treatment options grows, the market is expected to expand, driven by the need for innovative solutions to address these injuries effectively.

Growing Awareness of Orthopedic Health

There is a growing awareness of orthopedic health among the US population, which is influencing the orthopedic trauma-devices market. Educational campaigns and initiatives aimed at promoting bone health and injury prevention are becoming more prevalent. This heightened awareness is leading to earlier diagnosis and treatment of orthopedic conditions, resulting in increased demand for trauma devices. Furthermore, as individuals become more proactive about their health, they are more likely to seek out advanced treatment options. This trend is expected to drive market growth, as healthcare providers respond to the demand for innovative and effective orthopedic solutions.

Expansion of Outpatient Surgical Centers

The expansion of outpatient surgical centers in the US is reshaping the orthopedic trauma-devices market landscape. These facilities offer a more cost-effective and efficient alternative to traditional hospital settings for many orthopedic procedures. As outpatient centers become more prevalent, the demand for orthopedic trauma devices is likely to increase, as these facilities require advanced equipment to perform surgeries safely and effectively. The trend towards outpatient care is supported by a growing preference for minimally invasive procedures, which often result in shorter recovery times and lower overall costs. This shift is expected to contribute positively to the market, as more patients opt for outpatient surgical options.

Technological Innovations in Device Design

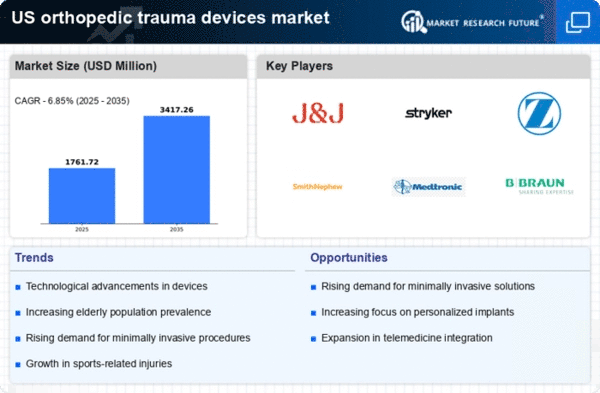

The orthopedic trauma-devices market is experiencing a wave of technological innovations that enhance the efficacy and safety of surgical procedures. Advancements in materials science, such as the development of bio-compatible and lightweight materials, are revolutionizing device design. Furthermore, the integration of smart technologies, including sensors and data analytics, allows for improved patient monitoring and outcomes. The market is projected to grow as these innovations lead to more effective treatment options, with estimates suggesting a compound annual growth rate (CAGR) of around 7% over the next five years. This growth is indicative of the increasing reliance on advanced technologies in orthopedic trauma care.