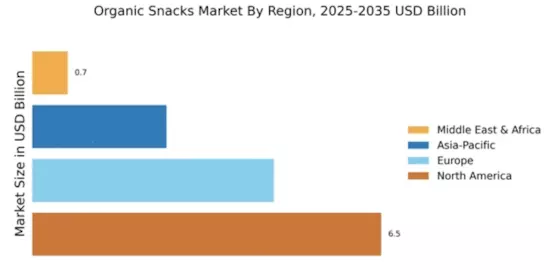

North America : Market Leader in Organic Snacks

North America continues to lead the organic snacks market, holding a significant share of 6.5 in 2024. The growth is driven by increasing health consciousness among consumers, a rising trend towards organic food consumption, and supportive regulatory frameworks promoting organic farming. The demand for clean-label products is also a key factor, as consumers seek transparency in food sourcing and ingredients. The competitive landscape is robust, with major players like General Mills, Kraft Heinz, and PepsiCo dominating the market. The U.S. is the largest contributor, supported by a strong distribution network and innovative product offerings. Companies are increasingly focusing on sustainability and health benefits, which resonate well with the target demographic, further solidifying North America's position in the organic snacks sector.

Europe : Emerging Market for Organic Snacks

Europe's organic snacks market is expanding, with a market size of 4.5 in 2024. The growth is fueled by increasing consumer awareness regarding health and wellness, alongside stringent regulations promoting organic farming practices. The European Union's commitment to sustainable agriculture and food safety standards has catalyzed the demand for organic snacks, making them more accessible to consumers. Leading countries in this region include Germany, France, and the UK, where the presence of key players like Nestle and Hain Celestial Group is notable. The competitive landscape is characterized by a mix of local and international brands, all vying for market share. The trend towards plant-based and organic ingredients is reshaping product offerings, aligning with consumer preferences for healthier snack options. "The organic food market in Europe is expected to grow significantly, driven by consumer demand for sustainable and healthy products," European Commission report.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a gradual increase in the organic snacks market, with a size of 1.8 in 2024. The Asia-Pacific region is witnessing a gradual increase in the organic snacks market, driven by urbanization and growing health awareness. Countries such as India are emerging as key contributors, strengthening the india organic snacks market through rising disposable incomes and expanding retail availability. This growth is primarily driven by rising disposable incomes, urbanization, and a growing awareness of health and wellness among consumers. Regulatory support for organic farming and food safety standards is also contributing to the market's expansion, as consumers seek healthier snack alternatives. Countries like Australia, Japan, and China are leading the charge in this emerging market. The competitive landscape is evolving, with both local and international brands vying for market share. Companies such as Boulder Canyon and Annie's Homegrown are making inroads, catering to the increasing demand for organic snacks. The region's diverse consumer preferences present opportunities for innovation and product development in the organic snacks sector.

Middle East and Africa : Emerging Organic Snack Market

The Middle East and Africa region is at the nascent stage of developing its organic snacks market, currently valued at 0.66 in 2024. The growth potential is significant, driven by increasing health awareness and a shift towards organic products among consumers. Regulatory frameworks are gradually evolving to support organic farming, which is expected to enhance market growth in the coming years. Countries like South Africa and the UAE are leading the way, with a growing interest in organic food products. The competitive landscape is still developing, with local brands beginning to emerge alongside international players. As consumer preferences shift towards healthier options, the market for organic snacks is poised for substantial growth, presenting opportunities for both new entrants and established brands.