E-Commerce Growth

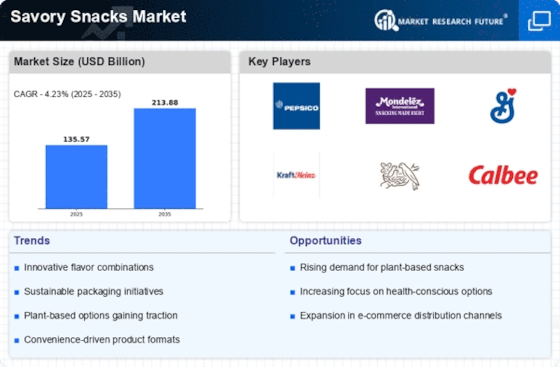

The Savory Snacks Market is experiencing a significant transformation due to the rapid growth of e-commerce. With the increasing penetration of the internet and mobile devices, consumers are turning to online platforms for their snack purchases. This shift is particularly pronounced among younger consumers who prefer the convenience of online shopping. E-commerce provides brands with an opportunity to reach a broader audience, allowing for direct-to-consumer sales and personalized marketing strategies. Recent statistics reveal that online sales of savory snacks have seen substantial growth, indicating a shift in consumer purchasing behavior. This trend is likely to continue, as the Savory Snacks Market adapts to the evolving retail landscape, emphasizing the importance of digital presence and online engagement.

Exotic Flavors and Fusion

The Savory Snacks Market is increasingly characterized by the incorporation of exotic flavors and fusion cuisines. As consumers become more adventurous in their culinary preferences, there is a growing demand for snacks that offer unique taste experiences. This trend is reflected in the introduction of flavors inspired by global cuisines, such as spicy Sriracha, tangy tamarind, and savory umami. Manufacturers are responding by developing innovative products that blend traditional snack formats with these bold flavors. Market data indicates that snacks featuring unique flavor profiles are gaining popularity, particularly among younger demographics who seek novel experiences. This trend not only enhances consumer engagement but also drives competition within the Savory Snacks Market, as brands strive to differentiate themselves through flavor innovation.

Health-Conscious Offerings

The Savory Snacks Market is witnessing a notable shift towards health-conscious offerings. Consumers increasingly seek snacks that align with their dietary preferences, such as low-calorie, low-fat, and high-protein options. This trend is driven by a growing awareness of health and wellness, prompting manufacturers to innovate and reformulate products. For instance, the introduction of baked snacks instead of fried varieties has gained traction, appealing to health-oriented consumers. According to recent data, the demand for healthier snack options has surged, with a significant percentage of consumers willing to pay a premium for products that are perceived as healthier. This shift not only influences product development but also shapes marketing strategies within the Savory Snacks Market, as brands strive to communicate their health benefits effectively.

Convenience and On-the-Go Snacking

The Savory Snacks Market is significantly shaped by the growing demand for convenience and on-the-go snacking options. As lifestyles become increasingly fast-paced, consumers are seeking snacks that are easy to consume and fit seamlessly into their daily routines. This trend has led to the development of portable packaging and single-serving sizes, catering to busy individuals who require quick and satisfying snack solutions. Market Research Future indicates that the demand for convenient snack options is on the rise, particularly among working professionals and students. This shift is prompting manufacturers to innovate and create products that not only satisfy hunger but also align with the need for convenience. As a result, the Savory Snacks Market is likely to continue evolving to meet these changing consumer preferences.

Sustainability and Ethical Sourcing

The Savory Snacks Market is increasingly influenced by sustainability and ethical sourcing practices. Consumers are becoming more conscious of the environmental and social impact of their food choices, leading to a demand for snacks that are produced sustainably. Brands are responding by adopting eco-friendly packaging, sourcing ingredients responsibly, and promoting transparency in their supply chains. This trend is not only a response to consumer preferences but also aligns with broader societal movements towards sustainability. Market data suggests that products marketed as sustainable or ethically sourced are experiencing higher sales growth, indicating a shift in consumer priorities. As the Savory Snacks Market evolves, companies that prioritize sustainability may gain a competitive edge, appealing to environmentally conscious consumers.