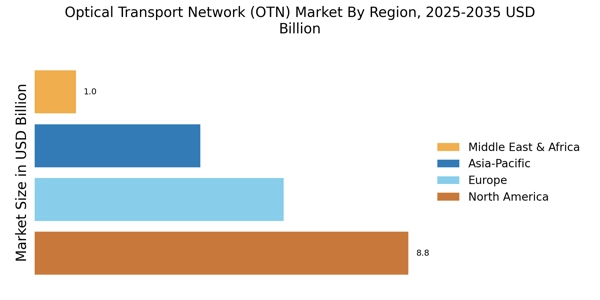

By region, the analysis offers market insights into North America, Asia Pacific, Europe, and the Rest of the World. The North American Optical Transport Network Market (OTN) market is expected to lead the market during the forecast period. Due to the use of high-speed communication technologies in the core network, such as Wavelength Division Multiplexer (WDM) and 100G coherent technology, the market in North American countries has grown. The US optical transport network market leads North America, driven by strong investments in 5G, cloud infrastructure, and data center expansion. The Canada optical transport network market is witnessing steady growth due to increasing broadband penetration and government digital initiatives.

Further, the key countries considered in the market report are The US, Canada, German, France, the UK, Spain, Italy, China, Japan, India, South Korea, Brazil, and Australia.

Figure 3: OPTICAL TRANSPORT NETWORK (OTN) MARKET SHARE BY REGION 2022 (USD Billion)

Europe Optical Transport Network Market (OTN) market accounts for the second-highest market share. This is due to the demand for fast and dependable connectivity in Europe due to increasing internet penetration and the growing popularity of cloud-based services. OTN makes it possible to connect quickly and securely to support cloud services and data center interconnectivity by allowing the transportation of massive amounts of data over long distances. Further, the German Optical Transport Network Market (OTN) market held the largest market share, and the UK Optical Transport Network Market (OTN) market was the fastest-growing market in the European region. The UK optical transport network market is expanding due to increasing cloud adoption and growing data center interconnect requirements. The Germany optical transport network market held the largest share in Europe, supported by strong industrial digitalization and telecom investments. The France optical transport network market is growing steadily due to rising demand for high-speed broadband and enterprise networking.

The Asia Pacific Optical Transport Network Market (OTN) Market is expected to grow at the fastest CAGR from 2023 to 2032. The Asia Pacific regional market is growing due to an increasing population, quick industrialization, and the adoption of new technology. The fact that the Internet is used for many different purposes, such as commercial transactions, online gaming, social networking, video conferencing, and online shopping, is another important aspect of the market for optical transport networks. The APAC optical transport network market is expected to grow at the fastest CAGR, supported by rapid industrialization and rising data traffic. The China optical transport network market held the largest share in the Asia Pacific region, supported by large-scale 5G and backbone network deployments. The India optical transport network market is the fastest-growing in the region, driven by expanding telecom networks and data center investments. The Japan optical transport network market benefits from advanced telecom infrastructure and early adoption of high-capacity optical technologies. The South Korea optical transport network market is driven by nationwide 5G rollout and strong government support for digital infrastructure.

Moreover, China’s Optical Transport Network Market (OTN) market held the largest market share, and the Indian Optical Transport Network Market (OTN) market was the fastest-growing market in the Asia Pacific region.