Expansion of 5G Networks

The rollout of 5G networks in Japan significantly influences the optical transport-network market. As telecommunications companies invest heavily in 5G infrastructure, the demand for optical transport solutions that can handle increased data traffic is expected to rise. The optical transport-network market is likely to benefit from the need for backhaul solutions that connect 5G base stations to core networks. By 2025, the market could see an increase in revenue by over $1 billion, driven by the integration of optical technologies that support the high bandwidth and low latency requirements of 5G. This expansion not only enhances mobile connectivity but also stimulates growth in various sectors, including healthcare and smart cities.

Emergence of Smart Cities

The development of smart cities in Japan is a key driver for the optical transport-network market. As urban areas evolve into interconnected ecosystems, the demand for reliable and high-capacity optical networks intensifies. Smart city initiatives, which encompass various applications such as traffic management, public safety, and energy efficiency, require robust data transmission capabilities. The optical transport-network market is likely to see increased investments as municipalities seek to implement these technologies. By 2025, the market could experience growth of around 15%, driven by the need for infrastructure that supports the seamless integration of smart technologies. This trend highlights the optical transport-network market's role in shaping the future of urban living.

Increased Focus on Network Security

In the context of the optical transport-network market, the growing emphasis on network security is becoming increasingly relevant. As cyber threats evolve, organizations in Japan are prioritizing secure data transmission methods. Optical networks, known for their inherent security advantages, are gaining traction as a preferred solution. The market is likely to witness a shift towards technologies that incorporate advanced encryption and security protocols. By 2025, investments in secure optical transport solutions may account for approximately 20% of total market expenditure, reflecting a strategic move to safeguard sensitive information. This trend underscores the importance of security in the optical transport-network market, as businesses seek to protect their data assets.

Rising Demand for High-Speed Connectivity

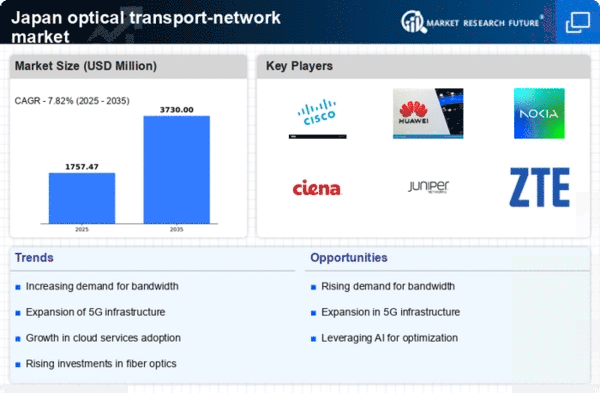

The optical transport-network market in Japan is experiencing a notable surge in demand for high-speed connectivity. As businesses and consumers increasingly rely on data-intensive applications, the need for robust and efficient optical networks becomes paramount. The proliferation of cloud computing, IoT devices, and streaming services drives this demand, compelling service providers to enhance their infrastructure. In 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the urgency for faster data transmission. This trend indicates that the optical transport-network market is pivotal in supporting Japan's digital transformation, ensuring that both urban and rural areas have access to high-speed internet.

Government Investments in Digital Infrastructure

The optical transport-network market in Japan is poised to benefit from substantial government investments aimed at enhancing digital infrastructure. The Japanese government has recognized the critical role of advanced telecommunications in economic growth and is likely to allocate significant funding towards optical network development. Initiatives to improve broadband access in rural areas and support for next-generation technologies are expected to drive market expansion. By 2025, government spending on digital infrastructure could exceed ¥1 trillion, creating opportunities for optical transport solutions. This proactive approach indicates a commitment to fostering innovation and ensuring that the optical transport-network market remains competitive and resilient.