Market Share

Introduction: Navigating the Competitive Landscape of Optical Transport Networks

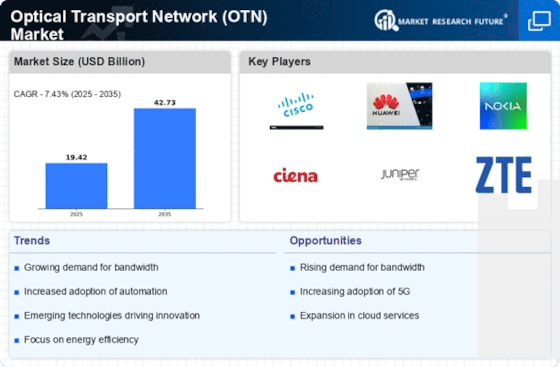

The Optical Transport Network (OTN) market is experiencing an unprecedented level of competition. This is the result of a combination of rapidly evolving technology, changing regulatory frameworks, and increasing customer demand for high-quality, seamless connections. The main players, including system manufacturers, IT service providers, and network operators, are competing to be the first to offer new services and solutions, based on new technologies such as artificial intelligence, automation, and IoT integration. The emergence of new companies, especially AI start-ups, is causing established players to rapidly adapt. As the focus on sustainable development increases, green infrastructure initiatives are reshaping the market, with further differentiation between the market players. The most significant growth opportunities are in Asia-Pacific and North America, where strategic deployments are in line with the increasing demand for high-capacity, low-latency connections. This market is set for major transformations and will continue to evolve significantly by 2024–25.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate various aspects of optical transport networks, providing end-to-end services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Huawei Technologies Co. Ltd | Strong R&D and global presence | Optical networking solutions | Asia, Europe, Africa |

| Cisco System Inc. | Leader in networking technology | IP and optical integration | Global |

| NOKIA | Innovative optical networking solutions | Optical transport and IP networks | Global |

| Ciena Corporation | Focus on adaptive networking | Optical transport solutions | North America, Europe |

| Alcatel-Lucent SA | Strong legacy in telecom solutions | Optical networking and services | Global |

Specialized Technology Vendors

These vendors focus on niche technologies within the optical transport space, offering specialized products and solutions.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Infinera | Innovative photonic integrated circuits | Intelligent transport networks | Global |

| ADVA Optical Networking | Expertise in open networking | Optical transport and synchronization | Europe, North America |

| Fujitsu Ltd | Strong in optical networking hardware | Optical transport systems | Asia, North America |

| ADTRAN | Focus on broadband access solutions | Optical transport and access | North America |

| Aliathon Technology Ltd | Specialized in optical transport technology | Optical transport solutions | Europe |

Infrastructure & Equipment Providers

These vendors provide essential infrastructure and equipment necessary for building and maintaining optical transport networks.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| ZTE Corp | Cost-effective solutions | Telecom equipment and services | Asia, Europe, Africa |

| Aten Technology Inc. | Focus on connectivity solutions | KVM and AV over IP solutions | Global |

| Allied Telesyn | Reliable networking solutions | Networking and optical solutions | Asia, North America |

| Britestream Networks Inc. | Specialized in video transport | Video transport solutions | North America |

| NCIPHER SECURITY, LLC | Focus on security solutions | Network security for transport | Global |

| Advanced Micro Devices Inc. | High-performance computing solutions | Semiconductors for networking | Global |

Emerging Players & Regional Champions

- IT specializes in high-capacity optical transport solutions with a focus on SDN. Recently it signed a contract to improve the backbone of a large North American telecommunications provider. The technology is a challenge to established players such as Cisco and Nokia, offering more flexible and scalable solutions.

- ADVA (Germany): Provides a wide range of OTN products, including optical transport and network synchronization. A recent project with a European service provider upgraded the metropolitan area network. Openness and interoperability are a key part of ADVA’s strategy, and this makes it a strong competitor to traditional vendors.

- Ciena (US): Known for its intelligent solutions, Ciena has been expanding its OTN portfolio with a focus on automation and analytics. Recent deployments include a partnership with a leading Asian telco to build a next-generation optical network. The company's software-based approach is a clear advantage over legacy systems.

- Then the prestigious Finnish company, whose name is a byword for high-quality equipment, whose OSN WaveSuite software makes its network management and administration more efficient. It has recently won a contract to modernize the telecommunications system of a country in the Middle East, thus strengthening its position against competitors like the Chinese company Huawei.

- ekinops (France): Its activity is centred on optical transport and access solutions, particularly for operators and enterprises. In recent times it has launched a new range of OTN products aimed at small and medium-sized operators, offering a cost-effective alternative to the products of the big vendors, thanks to its tailor-made solutions for the needs of these operators.

Regional Trends: In 2023, the OTN solutions will be widely adopted in the emerging markets of Asia and Africa, mainly driven by the increasing demand for high-speed Internet and data services. In addition, the popularity of SDN and automation will make the operators of these emerging markets differentiate themselves with their own technology and cost advantages. In terms of network standards, the shift from proprietary to open standards will also give the smaller operators a better way to compete with the giants.

Collaborations & M&A Movements

- Cisco and Nokia entered a partnership to enhance their optical transport solutions, aiming to improve network efficiency and reduce operational costs in response to increasing demand for high-capacity data transmission.

- Ciena acquired the optical networking division of a smaller tech firm to bolster its portfolio and strengthen its competitive positioning in the OTN market amid rising competition from established players.

- Infinera and ZTE announced a collaboration to develop next-generation optical transport systems, focusing on integrating advanced photonic technologies to meet the growing bandwidth requirements of telecom operators.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| High Capacity Transmission | Cisco, Huawei | The Cisco NCS 1004 platform supports up to 1.2 Tb/s per slot, which shows the company’s strength in high-capacity solutions. The OptiXtra series of products offer flexible bandwidth allocation and are widely used by telecommunications operators. |

| Network Automation | Nokia, Ciena | The AVA AI platform enhances automation through predictive analytics, which reduces operating costs. The Blue Planet software provides end-to-end automation, which has been successfully implemented in various large-scale networks. |

| Interoperability | Infinera, ADVA | DTN-X has been known for its interoperability with legacy systems. This facilitates migration. FSP 3000 has been recognized for its open architecture, which enables it to easily connect with third-party solutions. |

| Sustainability Initiatives | Cisco, Nokia | CISCO is committed to reducing its carbon footprint and has therefore implemented energy-efficient technologies in its OTN solutions. The same is true of NOKIA, which has been recognized for its efforts to reduce the energy consumption of its networks. |

| Scalability | Ciena, Huawei | The WaveLogic technology allows for a scalability of bandwidth that grows with the needs of customers. The CloudFabric solution supports a scalability of the network architecture, allowing operators to expand their services. |

| Security Features | Juniper Networks, Cisco | Juniper's security features for the OTN products are of the most advanced type, and have been adopted by several government agencies. The security features of Cisco's OTN products are based on a layered design, and they are very effective in preventing cyber attacks. |

Conclusion: Navigating OTN's Competitive Landscape

The Optical Transport Networks (OTN) market in 2023 is characterized by intense competition and a high degree of fragmentation, with both the historical and the new players fighting for market share. The trends in the regional markets are characterized by a strong emphasis on advanced functionality, especially in North America and Asia-Pacific, where the demand for high-capacity, reliable transport solutions is growing. The vendors strategically position themselves by using artificial intelligence, automation and green solutions to increase their operational efficiency and customer satisfaction. As the market evolves, the ability to offer flexible solutions that adapt to changing network demands will be crucial to maintaining leadership. This will not only be a source of differentiation, but also a source of competitive advantage in a rapidly changing landscape.

Leave a Comment