Government Incentives and Support

Government incentives play a crucial role in the growth of the Off-highway Electric Vehicle Market. Various countries are implementing policies that promote the adoption of electric vehicles through tax breaks, grants, and subsidies. These initiatives are designed to reduce the financial burden on manufacturers and consumers, thereby accelerating the transition to electric alternatives. For example, in 2025, several regions have reported increased funding for electric vehicle infrastructure, which is expected to enhance the market's appeal. This support not only encourages investment in electric technologies but also fosters a competitive environment that drives innovation within the Off-highway Electric Vehicle Market.

Advancements in Charging Infrastructure

The development of robust charging infrastructure is a pivotal driver for the Off-highway Electric Vehicle Market. As electric vehicles become more prevalent, the need for efficient and accessible charging solutions is paramount. In 2025, advancements in fast-charging technologies and the establishment of widespread charging networks are expected to facilitate the adoption of electric vehicles in off-highway applications. This infrastructure not only alleviates range anxiety among users but also enhances the operational efficiency of electric machinery. The ongoing investments in charging solutions indicate a commitment to supporting the Off-highway Electric Vehicle Market, thereby fostering its growth.

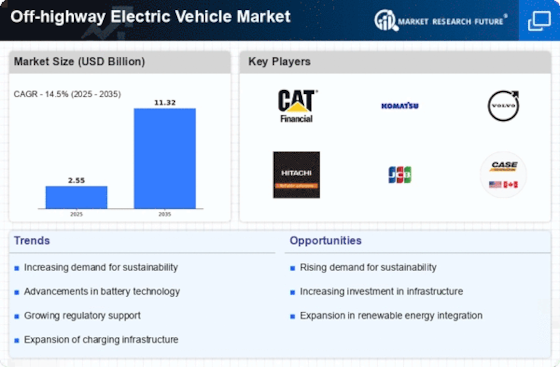

Rising Demand for Sustainable Solutions

The Off-highway Electric Vehicle Market is witnessing a rising demand for sustainable solutions, driven by increasing awareness of environmental issues. As industries seek to reduce their carbon footprints, electric vehicles are becoming a preferred choice due to their lower emissions compared to traditional diesel-powered machinery. In 2025, the market is projected to expand as companies prioritize sustainability in their operations. This shift is further supported by consumer preferences that favor eco-friendly products, indicating a broader trend towards sustainability. Consequently, the Off-highway Electric Vehicle Market is likely to benefit from this growing demand, leading to increased investments and innovations.

Increased Focus on Operational Efficiency

The Off-highway Electric Vehicle Market is increasingly focused on operational efficiency, which is driving the adoption of electric vehicles. Companies are recognizing that electric machinery can offer lower operating costs, reduced maintenance, and improved productivity. In 2025, the market is likely to see a shift as businesses prioritize investments in electric solutions that enhance their operational capabilities. This focus on efficiency is not only beneficial for the bottom line but also aligns with broader sustainability goals. As a result, the Off-highway Electric Vehicle Market is poised for growth, as more companies transition to electric alternatives to optimize their operations.

Technological Innovations in Electric Powertrains

The Off-highway Electric Vehicle Market is experiencing a surge in technological innovations, particularly in electric powertrains. These advancements enhance the efficiency and performance of electric vehicles, making them more appealing to consumers and businesses alike. For instance, the development of high-torque electric motors and advanced battery management systems has led to improved operational capabilities. As of 2025, the market for electric powertrains is projected to grow significantly, driven by the need for more efficient and sustainable machinery in sectors such as agriculture and construction. This trend indicates a shift towards electrification, which is likely to redefine operational standards in the Off-highway Electric Vehicle Market.