Advancements in Charging Infrastructure

The development of charging infrastructure is a critical driver for the off highway-electric-vehicle market. As electric vehicles become more prevalent, the need for accessible and efficient charging solutions is paramount. Investments in charging stations, particularly in rural and industrial areas, are expected to enhance the usability of electric vehicles. Recent data suggests that the number of charging stations in the US has increased by over 30% in the past year alone. This expansion not only alleviates range anxiety but also encourages fleet operators to transition to electric options. Consequently, the growth of charging infrastructure is likely to play a pivotal role in the expansion of the off highway-electric-vehicle market.

Rising Fuel Prices and Operational Costs

Rising fuel prices and operational costs are compelling many businesses to consider electric vehicles as a cost-effective alternative. The volatility of fossil fuel prices has led to increased operational expenses for companies relying on traditional machinery. In contrast, electric vehicles offer lower operating costs, particularly in terms of fuel and maintenance. Data indicates that electric vehicles can reduce operational costs by up to 30% compared to their diesel counterparts. This financial incentive is driving the transition towards electric solutions in the off highway-electric-vehicle market, as businesses seek to optimize their expenditures while maintaining productivity.

Government Initiatives for Electrification

Government initiatives aimed at promoting electrification are a significant driver for the off highway-electric-vehicle market. Various federal and state programs are being implemented to encourage the adoption of electric vehicles through grants, tax incentives, and subsidies. For instance, the US government has allocated substantial funding to support the development of electric vehicle technologies and infrastructure. These initiatives not only lower the financial barriers for consumers but also stimulate innovation within the industry. As a result, the off highway-electric-vehicle market is poised to benefit from these supportive policies, which are likely to enhance market growth and adoption rates.

Increasing Demand for Sustainable Solutions

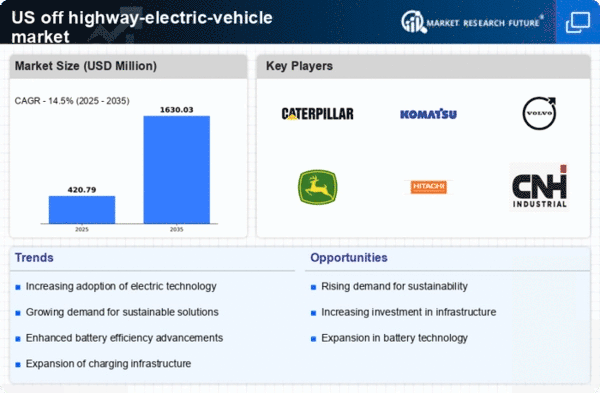

The off highway-electric-vehicle market is experiencing a notable surge in demand for sustainable solutions. This trend is driven by a growing awareness of environmental issues and the need for cleaner alternatives in industries such as agriculture, construction, and mining. As companies strive to reduce their carbon footprints, the adoption of electric vehicles is becoming a viable option. In fact, the market is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust shift towards electrification. This increasing demand for sustainable solutions is likely to propel the off highway-electric-vehicle market forward, as manufacturers respond to the evolving preferences of consumers and businesses alike.

Cost Reductions in Electric Vehicle Production

Cost reductions in the production of electric vehicles are significantly influencing the off highway-electric-vehicle market. As technology advances and economies of scale are achieved, the manufacturing costs of electric vehicles are decreasing. Reports indicate that battery costs have dropped by nearly 50% over the past five years, making electric vehicles more financially attractive to consumers and businesses. This trend is expected to continue, further driving the adoption of electric vehicles in off-highway applications. As production costs decline, the off highway-electric-vehicle market is likely to see an influx of new models and increased competition, ultimately benefiting end-users.