Top Industry Leaders in the Off highway Electric Vehicle Market

Off-Highway Electric Vehicle Market: Competitive Landscape

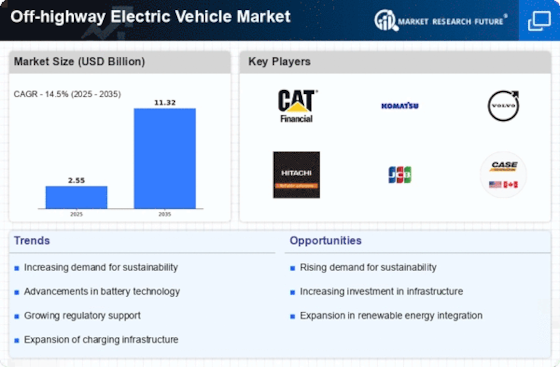

The off-highway electric vehicle (OH-EV) market is rapidly expanding, propelled by environmental regulations, technological progress, and the growing demand for sustainable solutions in diverse industries. This flourishing market is drawing in a varied array of established and emerging companies, shaping a dynamic and competitive scenario.

Key Players:

Prominent Automotive Manufacturers such as,

- LIEBHERR-International Deutschland GmbH

- Cargotec corporation

- Clark

- CNH Industrial

- Narrow Isle inc.

- Toyota Motor Corporation

- SANY Group

- Sandvik

- Epiroc

- Caterpillar

- Komatsu Ltd.

- Hitachi Construction Machinery

- DEERE & COMPANY

- JCB

- AB Volvo

- Anhui Heli Co., Ltd.

- Hyundai Doosan Infracore Co. Ltd., and others.

have invested significantly in OH-EV research and development. Leveraging their expertise in heavy machinery production and global distribution networks, they offer an extensive portfolio of OH-EVs across various applications, securing a substantial market share.

Specialized Electric Vehicle Companies like XCMG, Doosan Bobcat, BYD, and Green Machine have entered the market with innovative OH-EV offerings, concentrating on specific applications or niches. Often, they form partnerships with established players or technology providers to access resources and expertise, posing a challenge to traditional giants.

Technology Providers including Siemens, ABB, and Dana Incorporated supply electric motors, battery systems, and other essential components to OH-EV manufacturers. They play a pivotal role in propelling technological advancements and facilitating the development of efficient and powerful electric vehicles.

Strategies Adopted by Players:

Factors for Market Share Analysis:

New and Emerging Companies:

Several new and emerging players are entering the OH-EV market with disruptive technologies and business models. These companies often focus on specialized niches or offer unique features like modular designs or renewable energy integration. They pose a significant threat to established players by challenging their market dominance and pushing technological boundaries.

Latest Developments:

November 14, 2023:

- Komatsu Introduces New Battery-Electric Hydraulic Excavator: Komatsu unveiled the HB365-1 LEC, a new battery-electric hydraulic excavator aimed at the construction industry.

December 5, 2023:

- John Deere Invests in Electric Powertrain Technology: John Deere announced a strategic investment in Kreisel Electric, a leading developer of high-performance battery technology.

- Green Machine Expands Electric Forklift Production: Green Machine announced plans to expand its electric forklift production capacity in the US.