Nut Butters Market Summary

As per Market Research Future analysis, the Nut Butters Market Size was estimated at 3.7 USD Billion in 2024. The Nut Butters industry is projected to grow from 3.867 USD Billion in 2025 to 6.006 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Nut Butters Market is experiencing robust growth driven by health trends and innovative flavors.

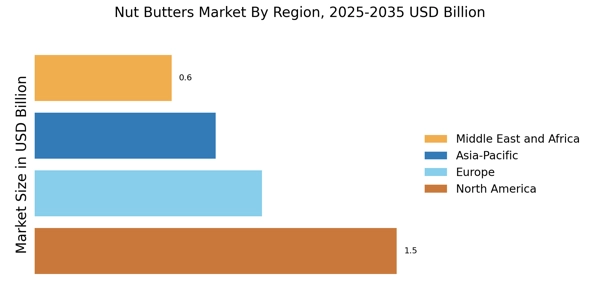

- The North American region remains the largest market for nut butters, characterized by a strong health and wellness focus.

- In contrast, the Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing consumer interest in plant-based diets.

- Peanut butter continues to dominate the market, while almond butter is rapidly gaining traction as a preferred choice among health-conscious consumers.

- Rising demand for plant-based proteins and increased awareness of nutritional benefits are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 3.7 (USD Billion) |

| 2035 Market Size | 6.006 (USD Billion) |

| CAGR (2025 - 2035) | 4.5% |

Major Players

Jif (US), Skippy (US), Nutella (IT), Peter Pan (US), MaraNatha (US), Justin's (US), SunButter (US), Crazy Richard's (US), Artisana Organics (US)