Technological Advancements

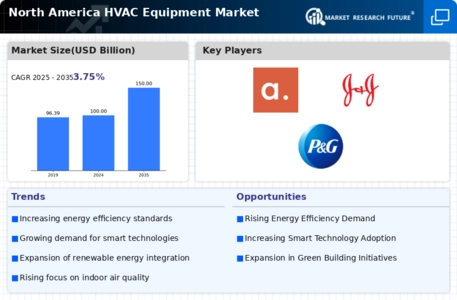

Technological advancements play a pivotal role in shaping the North America Equipment For Hvac Market. The integration of smart technologies, such as IoT-enabled devices and advanced control systems, is transforming traditional HVAC systems into more efficient and user-friendly solutions. These innovations allow for real-time monitoring and optimization of energy usage, which is particularly appealing to both residential and commercial sectors. The market is expected to witness a compound annual growth rate (CAGR) of around 6% as consumers increasingly adopt these technologies to enhance comfort and reduce operational costs. This trend indicates a shift towards more intelligent HVAC solutions that align with modern energy demands.

Energy Efficiency Regulations

The North America Equipment For Hvac Market is significantly influenced by stringent energy efficiency regulations imposed by government bodies. These regulations aim to reduce energy consumption and greenhouse gas emissions, thereby promoting sustainable practices. For instance, the U.S. Department of Energy has established minimum efficiency standards for HVAC equipment, which has led to a surge in demand for high-efficiency systems. As a result, manufacturers are increasingly investing in innovative technologies that enhance energy performance. The market is projected to grow as consumers and businesses seek to comply with these regulations, potentially leading to a market size increase of approximately 5% annually over the next five years.

Increased Construction Activities

The North America Equipment For Hvac Market is experiencing growth due to increased construction activities across residential, commercial, and industrial sectors. As urbanization continues to rise, there is a heightened demand for new buildings equipped with modern HVAC systems. According to recent data, the construction sector is expected to grow by approximately 4% annually, which directly correlates with the demand for HVAC equipment. This trend is further supported by government initiatives aimed at promoting sustainable building practices, leading to a greater emphasis on energy-efficient HVAC solutions. Consequently, manufacturers are likely to benefit from this surge in construction, driving market expansion.

Consumer Preference for Sustainable Solutions

Consumer preference for sustainable solutions is a key driver in the North America Equipment For Hvac Market. As environmental awareness grows, individuals and businesses are increasingly seeking HVAC systems that minimize environmental impact. This shift is reflected in the rising demand for eco-friendly refrigerants and energy-efficient technologies. Market Research Future indicates that approximately 60% of consumers are willing to invest in sustainable HVAC solutions, which is likely to propel market growth. Manufacturers are responding by innovating products that align with these preferences, thus enhancing their competitive edge. This trend suggests a promising future for the HVAC market as sustainability becomes a central focus for consumers.

Rising Demand for Indoor Air Quality Solutions

The growing awareness of indoor air quality (IAQ) is driving the North America Equipment For Hvac Market. With increasing concerns about health and well-being, consumers are prioritizing HVAC systems that improve air quality. This trend is particularly evident in commercial buildings, where regulations regarding IAQ are becoming more stringent. The market for air purification and filtration systems is expanding, with a projected growth rate of 7% over the next few years. Manufacturers are responding by developing advanced filtration technologies and ventilation solutions that not only enhance comfort but also ensure compliance with health standards, thereby boosting market demand.