Regulatory Compliance and Standards

The equipment for-hvac market is heavily influenced by regulatory compliance and standards set by government bodies. In the US, regulations aimed at reducing greenhouse gas emissions and improving energy efficiency are becoming increasingly stringent. For instance, the Department of Energy (DOE) has implemented new efficiency standards that require HVAC manufacturers to enhance their products. This regulatory environment compels manufacturers to innovate and invest in more efficient technologies, thereby driving growth in the market. As compliance becomes mandatory, the demand for advanced equipment that meets these standards is expected to rise, potentially increasing market value by 10% by 2027.

Economic Growth and Disposable Income Trends

The equipment for-hvac market is positively influenced by economic growth and rising disposable income levels in the US. As the economy continues to recover and expand, consumers and businesses are more inclined to invest in high-quality HVAC systems. Increased disposable income allows for greater spending on home improvements and energy-efficient upgrades. Recent economic forecasts suggest that household income is expected to rise by approximately 3% annually, which could lead to a corresponding increase in demand for advanced HVAC equipment. This economic backdrop creates a favorable environment for the equipment for-hvac market, as consumers seek to enhance comfort and efficiency in their living and working spaces.

Technological Advancements in HVAC Equipment

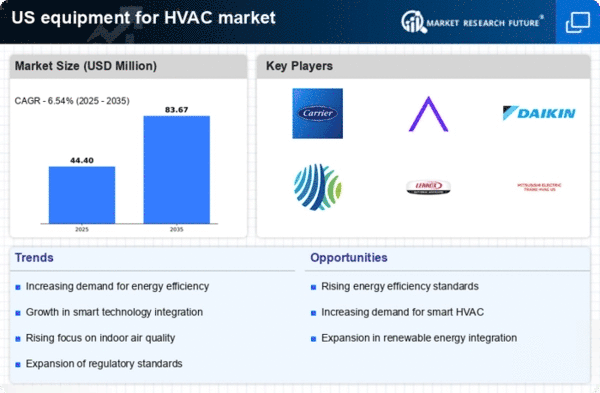

The equipment for-hvac market is experiencing a surge in technological advancements, which is driving demand for more efficient and innovative systems. The integration of IoT and smart technologies into HVAC equipment allows for enhanced control and monitoring, leading to improved energy efficiency and user convenience. As of 2025, the market for smart HVAC systems is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 15% over the next five years. This trend indicates a shift towards more sophisticated equipment that not only meets regulatory standards but also caters to consumer preferences for automation and connectivity.

Growing Construction and Renovation Activities

The equipment for-hvac market is benefiting from a robust construction and renovation landscape in the US. With an increase in residential and commercial building projects, there is a heightened demand for HVAC systems that can provide optimal climate control. According to recent data, the construction sector is projected to grow by approximately 5% annually, which directly correlates with the demand for new HVAC installations. Additionally, renovation projects often require upgrades to existing HVAC systems to meet modern efficiency standards, further propelling market growth. This trend indicates a sustained demand for equipment that can cater to both new constructions and retrofitting existing buildings.

Consumer Awareness and Demand for Sustainability

The equipment for-hvac market is increasingly shaped by consumer awareness regarding sustainability and environmental impact. As more consumers prioritize eco-friendly solutions, there is a growing demand for HVAC systems that utilize renewable energy sources and have lower carbon footprints. This shift in consumer behavior is prompting manufacturers to develop equipment that aligns with these values. Market Research Future indicates that nearly 60% of consumers are willing to pay a premium for energy-efficient systems, which suggests a significant opportunity for growth in the sector. This trend is likely to drive innovation in the equipment for-hvac market, as companies strive to meet evolving consumer expectations.