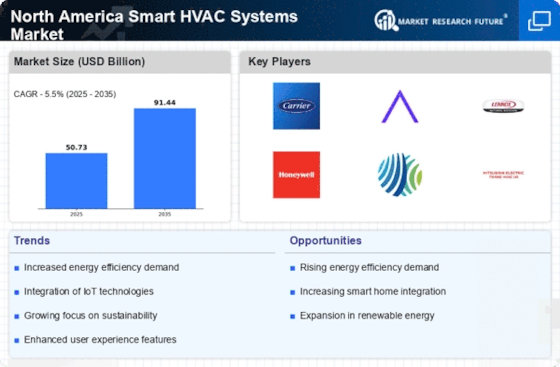

Rising Energy Costs

Rising energy costs are a significant driver for the North America Smart HVAC Systems Market. As energy prices continue to escalate, consumers and businesses are increasingly seeking solutions that can mitigate these expenses. Smart HVAC systems, with their ability to optimize energy consumption and provide real-time data analytics, offer a compelling solution to this challenge. Market analysis indicates that the implementation of smart HVAC technologies can lead to substantial reductions in energy bills, often by 20% or more. This financial incentive is prompting both residential and commercial sectors to invest in smart HVAC solutions, thereby accelerating market growth.

Increased Focus on Sustainability

The North America Smart HVAC Systems Market is witnessing an increased focus on sustainability, driven by both consumer preferences and regulatory frameworks. As environmental concerns gain prominence, there is a growing demand for energy-efficient and eco-friendly HVAC solutions. This shift is supported by various government initiatives aimed at reducing carbon footprints and promoting renewable energy sources. For instance, the U.S. Department of Energy has set ambitious targets for energy efficiency in buildings, which directly influences the HVAC market. Consequently, manufacturers are innovating to develop systems that not only comply with these regulations but also appeal to environmentally conscious consumers.

Rising Demand for Smart Home Solutions

The North America Smart HVAC Systems Market is experiencing a notable surge in demand for smart home solutions. As consumers increasingly seek convenience and control over their living environments, smart HVAC systems are becoming integral to modern homes. This trend is driven by the proliferation of smart devices and the growing awareness of energy management. According to recent data, the smart home market is projected to reach USD 174 billion by 2025, indicating a robust growth trajectory. This demand is further fueled by the desire for enhanced comfort, security, and energy efficiency, positioning smart HVAC systems as a pivotal component in the evolving landscape of home automation.

Growing Awareness of Indoor Air Quality

The growing awareness of indoor air quality (IAQ) is emerging as a crucial driver in the North America Smart HVAC Systems Market. Consumers are becoming more cognizant of the health implications associated with poor air quality, leading to an increased demand for HVAC systems that can effectively monitor and improve IAQ. Smart HVAC systems equipped with advanced filtration and ventilation technologies are well-positioned to address these concerns. Data suggests that improved IAQ can enhance productivity and overall well-being, making these systems attractive to both homeowners and businesses. As awareness continues to rise, the market for smart HVAC solutions is likely to expand further.

Technological Advancements in HVAC Systems

Technological advancements are significantly shaping the North America Smart HVAC Systems Market. Innovations such as machine learning, artificial intelligence, and advanced sensors are enhancing the functionality and efficiency of HVAC systems. These technologies enable predictive maintenance, real-time monitoring, and automated adjustments based on user preferences and environmental conditions. The integration of these advanced features not only improves energy efficiency but also reduces operational costs. Market data suggests that the adoption of smart HVAC technologies could lead to energy savings of up to 30%, making them an attractive option for both residential and commercial applications.