Rising Consumer Awareness and Preferences

Consumer awareness regarding indoor air quality and comfort is increasingly shaping The Equipment for HVAC Market. As individuals become more informed about the health impacts of air quality, there is a growing preference for HVAC systems that offer superior filtration and air purification capabilities. This trend is driving manufacturers to develop products that not only provide temperature control but also enhance indoor air quality. Market data suggests that consumers are willing to invest in advanced HVAC solutions that promise better air quality and energy efficiency. Consequently, this rising consumer awareness is likely to propel the demand for innovative HVAC equipment, thereby influencing the overall growth trajectory of The Global Equipment for HVAC Industry.

Technological Advancements in HVAC Systems

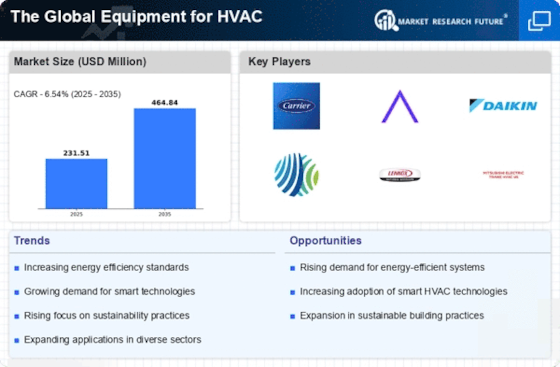

Technological advancements are playing a pivotal role in shaping The Equipment for HVAC Market. Innovations such as smart thermostats, IoT integration, and advanced control systems are enhancing the functionality and efficiency of HVAC equipment. These technologies enable real-time monitoring and optimization of HVAC systems, leading to improved performance and reduced operational costs. The market is projected to grow as these technologies become more accessible and affordable. For instance, the integration of AI and machine learning in HVAC systems allows for predictive maintenance, which can significantly reduce downtime and maintenance costs. As a result, the demand for technologically advanced HVAC solutions is expected to rise, further propelling The Global Equipment for HVAC Industry.

Urbanization and Infrastructure Development

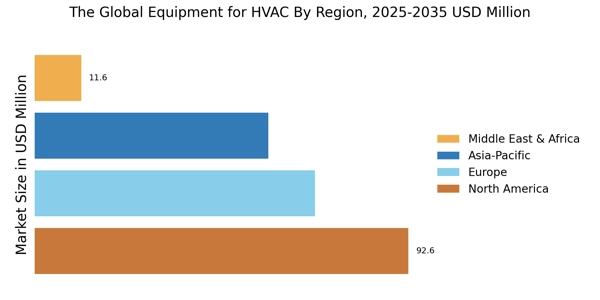

The ongoing urbanization and infrastructure development across various regions are significantly impacting The Equipment for HVAC Industry. As urban populations grow, the demand for residential and commercial buildings increases, leading to a higher need for effective HVAC systems. This trend is particularly evident in emerging economies, where rapid urbanization is driving investments in new construction projects. According to estimates, the construction sector is expected to grow at a compound annual growth rate of over 5% in the coming years, which will directly influence the demand for HVAC equipment. As a result, manufacturers are likely to focus on providing innovative and efficient solutions tailored to meet the needs of modern urban environments, thereby enhancing their presence in The Global Equipment for HVAC Industry.

Regulatory Support for Sustainable Practices

Regulatory frameworks aimed at promoting sustainability are increasingly influencing The Global Equipment for HVAC Market. Governments worldwide are implementing stringent regulations to reduce greenhouse gas emissions and promote the use of environmentally friendly refrigerants. These regulations are compelling manufacturers to innovate and develop products that comply with new standards. For example, the phase-out of high Global Warming Potential (GWP) refrigerants is pushing the industry towards the adoption of low-GWP alternatives. This shift not only aligns with The Equipment for HVAC Market opportunities for manufacturers who can provide compliant and efficient HVAC solutions. Consequently, regulatory support is likely to drive growth in The Global Equipment for HVAC Industry as companies adapt to these evolving standards.

Increasing Demand for Energy Efficient Solutions

The rising awareness regarding energy conservation is driving the demand for energy efficient solutions in the HVAC sector. As consumers and businesses seek to reduce their energy bills and carbon footprints, The Global Equipment for HVAC Industry is witnessing a shift towards high-efficiency systems. According to recent data, energy-efficient HVAC systems can reduce energy consumption by up to 30% compared to traditional systems. This trend is further supported by government regulations and incentives aimed at promoting energy efficiency, which are likely to bolster market growth. Manufacturers are responding by innovating and offering advanced technologies that not only meet but exceed energy efficiency standards, thereby enhancing their competitive edge in The Global Equipment for HVAC Industry.