Natural Food Color Ingredients Market Summary

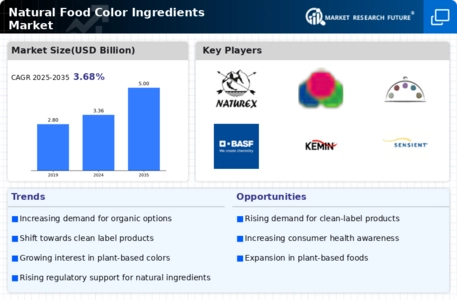

As per MRFR analysis, the Natural Food Color Ingredients Market was estimated at 3.36 USD Billion in 2024. The Natural Food Color Ingredients industry is projected to grow from 3.484 USD Billion in 2025 to 5.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.68 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Natural Food Color Ingredients Market is experiencing a transformative shift towards plant-based solutions and clean label products.

- The market is witnessing a notable shift towards plant-based colorants, driven by consumer preferences for natural ingredients.

- North America remains the largest market for natural food color ingredients, while Asia-Pacific is recognized as the fastest-growing region.

- In the plant-based segment, which is the largest, there is a rising interest in vegan and vegetarian options, particularly in beverages.

- Key market drivers include growing consumer awareness of health benefits and regulatory support for natural ingredients, fueling demand across various sectors.

Market Size & Forecast

| 2024 Market Size | 3.36 (USD Billion) |

| 2035 Market Size | 5.0 (USD Billion) |

| CAGR (2025 - 2035) | 3.68% |

Major Players

Döhler (DE), Sensient Technologies (US), Naturex (FR), Kalsec (US), Chr. Hansen (DK), BASF (DE), Givaudan (CH), FMC Corporation (US), Tate & Lyle (GB)

Leave a Comment