Rising Need for Rapid Deployment

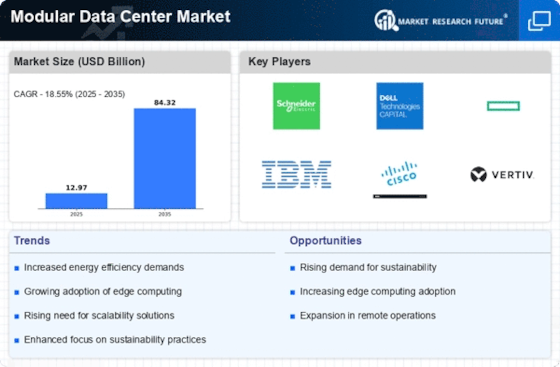

The Modular Data Center Market is experiencing a notable surge in demand for rapid deployment solutions. Organizations are increasingly seeking ways to establish data centers quickly to meet the growing needs of digital transformation. This trend is driven by the necessity for businesses to adapt to changing market conditions and consumer expectations. Modular data centers offer a flexible and efficient approach, allowing companies to deploy infrastructure in a matter of weeks rather than months. According to recent estimates, the modular data center segment is projected to grow at a compound annual growth rate of over 25% in the coming years, indicating a robust market response to the need for speed in deployment. This driver highlights the importance of agility in the current technological landscape.

Enhanced Sustainability Initiatives

Sustainability has become a pivotal focus within the Modular Data Center Market, as organizations strive to reduce their carbon footprint. Modular data centers are designed with energy efficiency in mind, often utilizing advanced cooling technologies and renewable energy sources. This shift towards sustainable practices is not merely a trend but a necessity, as regulatory pressures and consumer expectations for environmentally responsible operations continue to rise. The market is witnessing a growing number of companies adopting modular solutions that align with their sustainability goals. Reports suggest that energy-efficient modular data centers can reduce energy consumption by up to 30%, making them an attractive option for businesses aiming to enhance their environmental credentials while maintaining operational efficiency.

Integration of Advanced Technologies

The integration of advanced technologies is a significant driver within the Modular Data Center Market. Innovations such as artificial intelligence, machine learning, and IoT are increasingly being incorporated into modular data center designs. These technologies enhance operational efficiency, improve resource management, and enable predictive maintenance, thereby reducing downtime. As organizations seek to leverage data analytics and automation, the demand for modular solutions that can seamlessly integrate these technologies is expected to rise. The market is likely to see a shift towards smart modular data centers that not only provide physical infrastructure but also intelligent management systems. This evolution could potentially reshape the competitive landscape, as companies that adopt these technologies may gain a substantial advantage.

Growing Demand for Edge Computing Solutions

The Modular Data Center Market is significantly influenced by the growing demand for edge computing solutions. As businesses increasingly rely on real-time data processing and low-latency applications, the need for localized data centers has become apparent. Modular data centers are ideally suited for edge computing, as they can be deployed in proximity to end-users, thereby reducing latency and improving service delivery. This trend is particularly evident in sectors such as telecommunications, healthcare, and smart cities, where immediate data access is critical. Market analyses indicate that the edge computing segment is expected to witness substantial growth, further driving the adoption of modular data centers as organizations seek to enhance their operational capabilities.

Cost-Effectiveness and Operational Efficiency

Cost-effectiveness remains a crucial driver in the Modular Data Center Market. Organizations are increasingly looking for solutions that not only meet their technical requirements but also align with budgetary constraints. Modular data centers offer a cost-efficient alternative to traditional data center builds, as they require lower capital expenditure and can be scaled according to demand. This flexibility allows businesses to optimize their investments and reduce operational costs. Furthermore, the modular approach facilitates easier upgrades and expansions, which can lead to long-term savings. Market trends suggest that companies adopting modular solutions can achieve operational efficiencies of up to 40%, making this an attractive proposition for organizations aiming to enhance their financial performance while maintaining robust IT infrastructure.