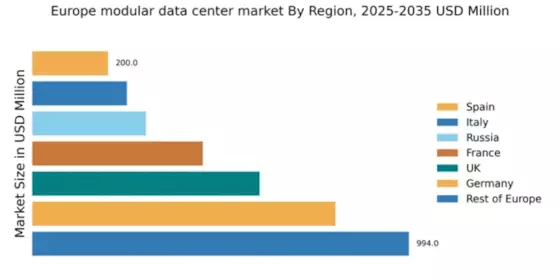

Germany : Strong Infrastructure and Innovation Hub

Key markets include major cities like Frankfurt, Berlin, and Munich, which are pivotal for data center operations. The competitive landscape features major players such as Rittal, Schneider Electric, and IBM, all of which have established a strong presence. The local business environment is characterized by a focus on innovation and efficiency, with applications spanning finance, healthcare, and telecommunications sectors.

UK : Innovation and Demand Surge

Key markets include London, Manchester, and Birmingham, which are central to the data center ecosystem. The competitive landscape features major players like Dell Technologies and Microsoft, which are investing heavily in local infrastructure. The business environment is dynamic, with a focus on fintech, e-commerce, and media sectors driving demand for modular solutions.

France : Sustainability and Innovation Focus

Key markets include Paris, Lyon, and Marseille, which are vital for data center operations. The competitive landscape features significant players like Schneider Electric and IBM, which are enhancing their local presence. The business environment is characterized by a strong emphasis on sustainability, with applications in sectors such as finance, healthcare, and smart cities.

Russia : Market Potential and Regulatory Hurdles

Key markets include Moscow and St. Petersburg, which are central to the data center landscape. The competitive environment features local players and international firms like Huawei Technologies. The business climate is complex, with a focus on telecommunications and government sectors driving demand for modular solutions, despite regulatory hurdles.

Italy : Investment and Innovation Opportunities

Key markets include Milan, Rome, and Turin, which are essential for data center operations. The competitive landscape features players like Vertiv and Dell Technologies, which are expanding their footprint. The local business environment is evolving, with a focus on e-commerce and digital services driving demand for modular data centers.

Spain : Digital Transformation and Growth

Key markets include Madrid and Barcelona, which are pivotal for data center operations. The competitive landscape features players like Cisco Systems and IBM, which are investing in local infrastructure. The business environment is characterized by a growing emphasis on technology and innovation, with applications in sectors such as finance and telecommunications.

Rest of Europe : Varied Growth Across Regions

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region. The competitive landscape features a mix of local and international players, including major firms like Microsoft and Huawei Technologies. The business environment is diverse, with applications spanning various sectors, including finance, healthcare, and manufacturing, each with unique demands for modular data centers.