Cost Efficiency and Scalability

Cost efficiency remains a significant driver for the modular data-center market. Organizations in Germany are increasingly drawn to modular solutions due to their ability to reduce capital expenditures and operational costs. Modular data centers allow for incremental scaling, enabling businesses to expand their infrastructure in alignment with demand. This flexibility is particularly appealing in a competitive market where financial prudence is paramount. Reports indicate that companies can achieve up to 30% savings in operational costs by adopting modular designs compared to traditional data centers. As the need for scalable solutions grows, the modular data-center market is likely to see heightened interest from enterprises looking to optimize their IT investments.

Increased Focus on Data Security

Data security concerns are becoming increasingly prominent, influencing the modular data-center market. As cyber threats evolve, organizations in Germany are prioritizing secure data storage and processing solutions. Modular data centers offer enhanced security features, including physical security measures and advanced encryption technologies. This focus on security is particularly relevant for industries such as finance and healthcare, where data protection is paramount. The modular data-center market is likely to see growth as companies seek to implement robust security protocols. It is estimated that investments in secure modular solutions could increase by 25% over the next few years, reflecting the urgent need for businesses to safeguard sensitive information.

Growing Demand for Edge Computing

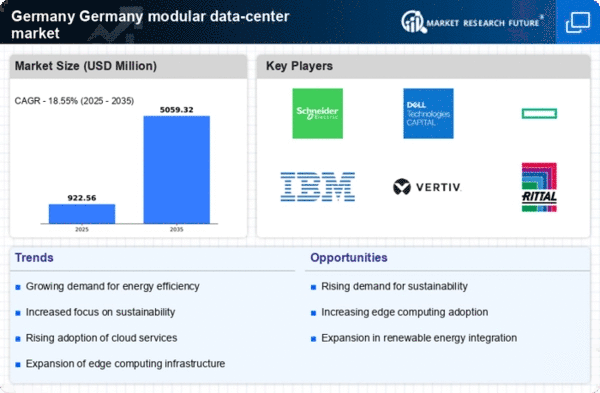

The increasing reliance on edge computing is a pivotal driver for the modular data-center market. As businesses in Germany seek to enhance data processing capabilities closer to the source, modular data centers offer a flexible and efficient solution. This trend is particularly pronounced in sectors such as manufacturing and automotive, where real-time data analysis is crucial. The modular data-center market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for low-latency processing and improved operational efficiency. Companies are increasingly investing in modular solutions to meet the demands of IoT applications and smart technologies, which require robust infrastructure to support vast amounts of data generated at the edge.

Technological Advancements in Cooling Solutions

Innovations in cooling technologies are driving the modular data-center market forward. Efficient cooling systems are essential for maintaining optimal performance and energy efficiency in data centers. In Germany, advancements such as liquid cooling and free cooling techniques are becoming increasingly popular. These technologies not only enhance energy efficiency but also reduce the overall carbon footprint of data centers. The modular data-center market is expected to benefit from these developments, as companies prioritize sustainability and the energy efficiency. With energy costs rising, the adoption of advanced cooling solutions could lead to a reduction in energy consumption by up to 40%, making modular data centers a more attractive option for businesses aiming to lower operational costs.

Government Incentives for Digital Infrastructure

Government initiatives aimed at enhancing digital infrastructure are a key driver for the modular data-center market. In Germany, policies promoting digitalization and technological innovation are encouraging investments in modular solutions. These initiatives often include financial incentives, grants, and tax benefits for companies that adopt advanced data center technologies. As the government emphasizes the importance of digital transformation, the modular data-center market is poised for growth. It is anticipated that public sector investments in digital infrastructure could reach €1 billion by 2027, further stimulating demand for modular data centers. This supportive regulatory environment is likely to attract both domestic and international players to the market.