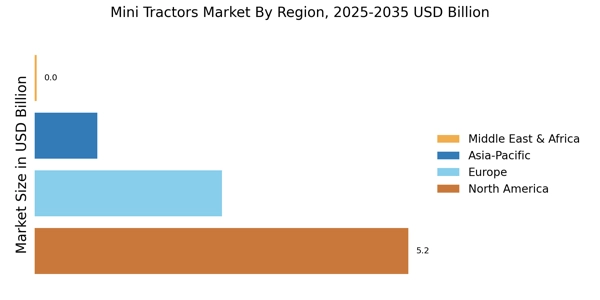

By region, the study provides market insights into North America, Europe, Asia-Pacific, and Rest of the World. The anticipated expansion of the market in North America can be attributed to several key factors. North American farmers are increasingly favoring compact and versatile equipment like mini tractors. Recent data from the Association of Equipment Manufacturers (AEM) indicates a notable 10.6 percent increase in overall unit sales of U.S. combines compared to July 2022.

This trend is particularly relevant as mini tractors prove to be well-suited for the prevalent small to medium-sized farms in the region, enabling efficient handling of a diverse range of agricultural tasks.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: MINI TRACTORS MARKET SHARE BY REGION 2022 (USD Billion)

Europe Mini Tractors Market accounts for the second-largest market share as the agricultural sector in Europe is experiencing a significant modernization drive, marked by an escalating focus on operational efficiency and sustainability. Mini tractors, known for their versatility and suitability for smaller land holdings, seamlessly integrate with the evolving dynamics of European agriculture. According to estimates by CEMA, the European agricultural machinery market (including the European Union and the United Kingdom) demonstrated substantial growth, reaching a value of €34.2 billion for manufacturers in 2021—an impressive 20% increase compared to 2020.

France emerged as the largest European market, contributing €7 billion, followed by Germany, Italy, the United Kingdom, and Poland. Collectively, these top five markets accounted for 66% of the total market share in 2021. The increasing market value indicates a positive environment for equipment manufacturers, including those producing mini tractors. Further, the German Market held the largest market share, and the UK Mini Tractors Market was the fastest-growing market in the European region

The Asia-Pacific Market is expected to grow at the fastest CAGR from 2025 to 2034. Numerous nations in the Asia Pacific region, particularly India, exhibit a significant prevalence of small-scale and subsistence farming. Agriculture stands as the primary source of livelihood for a substantial portion of India's rural households, with 70 percent depending primarily on agricultural activities. Notably, 82 percent of farmers in the country fall under the category of small and marginal. The suitability of mini tractors, characterized by their compact size and versatility, is particularly evident in these smaller landholdings.

The rising adoption of mini tractors is driven by the imperative need for efficient mechanization in such agricultural contexts. Moreover, China’s Mini Tractors Market held the largest market share, and the Indian Mini Tractors Market was the fastest-growing market in the Asia-Pacific region.