Government Support and Subsidies

Government initiatives play a crucial role in shaping the Agricultural Tractors Market. Many governments are implementing policies that provide financial support and subsidies to farmers for purchasing modern agricultural equipment. These initiatives aim to enhance productivity and ensure food security. For instance, in various regions, subsidies can cover a substantial portion of the cost of tractors, making them more accessible to smallholder farmers. This financial assistance not only encourages the adoption of advanced machinery but also stimulates growth within the Agricultural Tractors Market, as more farmers are likely to invest in tractors to improve their farming practices.

Rising Demand for Food Production

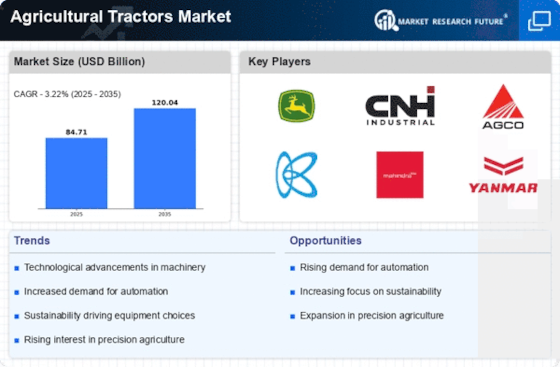

The Agricultural Tractors Market is experiencing a notable surge in demand driven by the increasing need for food production. As the global population continues to grow, the pressure on agricultural systems intensifies, necessitating enhanced productivity. In 2025, it is estimated that food production must increase by approximately 70% to meet the needs of the projected population. This demand compels farmers to adopt advanced agricultural machinery, including tractors, to optimize their operations. Consequently, the Agricultural Tractors Market is likely to witness significant growth as farmers invest in modern equipment to improve efficiency and yield.

Technological Innovations in Tractors

Technological advancements are transforming the Agricultural Tractors Market, with innovations such as precision farming and automation gaining traction. Modern tractors are now equipped with GPS technology, enabling farmers to optimize their field operations and reduce waste. The integration of data analytics allows for better decision-making regarding planting and harvesting. In 2025, it is projected that the market for smart tractors will expand significantly, as farmers increasingly recognize the benefits of these technologies. This trend indicates a shift towards more efficient and sustainable farming practices, further propelling the growth of the Agricultural Tractors Market.

Increasing Mechanization in Agriculture

The trend towards mechanization in agriculture is a pivotal driver for the Agricultural Tractors Market. As labor shortages become more pronounced, particularly in rural areas, farmers are turning to mechanized solutions to maintain productivity. The adoption of tractors and other machinery allows for faster and more efficient farming operations, reducing reliance on manual labor. In many regions, the mechanization rate is expected to rise, with projections indicating that by 2025, a significant percentage of farms will utilize tractors for various tasks. This shift not only enhances operational efficiency but also contributes to the overall growth of the Agricultural Tractors Market.

Sustainability and Environmental Concerns

Sustainability is becoming increasingly important within the Agricultural Tractors Market. Farmers are under pressure to adopt practices that minimize environmental impact while maximizing productivity. The demand for eco-friendly tractors, which utilize alternative fuels or are designed for lower emissions, is on the rise. In 2025, it is anticipated that a growing number of farmers will prioritize sustainability in their purchasing decisions, leading to an increase in the market share of environmentally friendly tractors. This shift reflects a broader trend towards sustainable agriculture, which is likely to drive innovation and growth within the Agricultural Tractors Market.