Rising Focus on Workplace Safety

Workplace safety remains a paramount concern across various industries, significantly influencing the Industrial Tow Tractors and Burden Carriers Market. The implementation of stringent safety regulations has prompted organizations to adopt equipment that minimizes risks associated with material handling. Tow tractors and burden carriers are designed with safety features such as automatic braking systems and ergonomic designs, which contribute to safer working environments. As a result, companies are more inclined to invest in these vehicles to comply with safety standards and protect their workforce. The increasing emphasis on safety is expected to propel market growth, as organizations prioritize the well-being of their employees while enhancing productivity.

Expansion of E-commerce and Retail Sectors

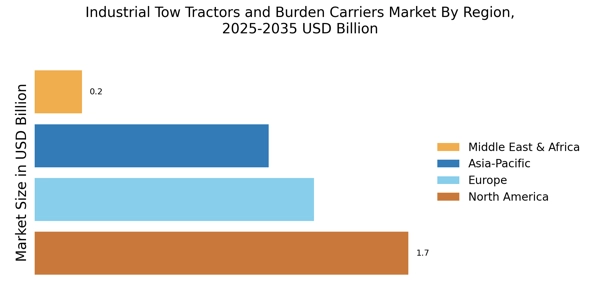

The rapid expansion of e-commerce and retail sectors is significantly impacting the Industrial Tow Tractors and Burden Carriers Market. As online shopping continues to gain traction, warehouses and distribution centers are under pressure to improve their logistics capabilities. This has led to a surge in demand for industrial tow tractors and burden carriers, which facilitate the efficient movement of goods within large facilities. Recent statistics indicate that the e-commerce sector is projected to grow by over 15% annually, further driving the need for effective material handling solutions. Consequently, businesses are increasingly investing in these vehicles to enhance their operational efficiency and meet the growing demands of consumers.

Growing Need for Customization and Versatility

The growing need for customization and versatility in material handling solutions is a key driver for the Industrial Tow Tractors and Burden Carriers Market. Businesses across various sectors are seeking equipment that can be tailored to their specific operational requirements. This demand for flexibility is prompting manufacturers to offer a range of customizable options, including different towing capacities and attachments. As companies strive to enhance their operational efficiency, the ability to adapt equipment to diverse tasks becomes increasingly valuable. This trend is likely to foster innovation within the market, as manufacturers respond to the evolving needs of their customers, ultimately driving growth in the industrial tow tractors and burden carriers segment.

Increased Demand for Efficient Logistics Solutions

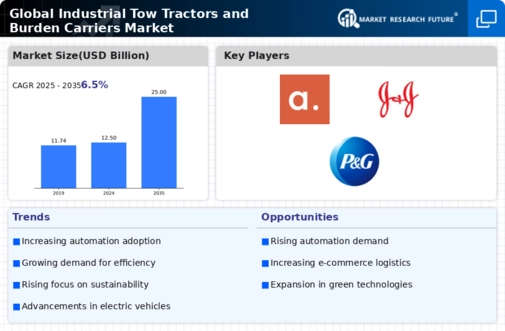

The Industrial Tow Tractors and Burden Carriers Market is experiencing heightened demand for efficient logistics solutions. As industries strive to optimize their supply chains, the need for reliable transportation of goods within facilities has surged. This trend is particularly evident in sectors such as manufacturing and warehousing, where the integration of tow tractors and burden carriers enhances operational efficiency. According to recent data, the market for industrial tow tractors is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is driven by the necessity for streamlined operations and reduced labor costs, as businesses increasingly recognize the value of investing in advanced material handling equipment.

Technological Innovations in Material Handling Equipment

Technological innovations are reshaping the Industrial Tow Tractors and Burden Carriers Market, as manufacturers introduce advanced features that enhance performance and usability. Innovations such as electric-powered tow tractors and automated burden carriers are gaining traction, offering improved energy efficiency and reduced operational costs. The integration of smart technologies, including IoT and AI, allows for real-time monitoring and predictive maintenance, further optimizing equipment performance. As industries seek to modernize their operations, the adoption of these technologically advanced solutions is expected to rise. This trend not only improves productivity but also aligns with sustainability goals, as businesses increasingly prioritize eco-friendly practices in their material handling processes.