Growing Interest in Hobby Farming

The mini tractors market is experiencing a rise in interest from hobby farmers and urban dwellers seeking to cultivate their own food. This trend is fueled by a growing awareness of sustainable living and the desire for self-sufficiency. As more individuals engage in gardening and small-scale farming, the demand for mini tractors is likely to increase. The market is projected to see a growth rate of around 5% annually, as hobbyists look for efficient and manageable equipment to assist in their agricultural endeavors. The mini tractors market is thus adapting to cater to this demographic, offering models that are user-friendly and suitable for non-professional farmers. This shift towards hobby farming is expected to contribute positively to the overall growth of the mini tractors market.

Increased Adoption of Precision Agriculture

The mini tractors market is witnessing a surge in the adoption of precision agriculture techniques. Farmers are increasingly utilizing technology to enhance productivity and reduce waste, which is driving the demand for mini tractors equipped with advanced features. These tractors often come with GPS technology, automated steering, and data analytics capabilities, allowing for more precise farming practices. According to recent data, the precision agriculture market is expected to reach $12 billion by 2026, indicating a strong correlation with the mini tractors market. As farmers seek to optimize their operations, the integration of precision technology into mini tractors is likely to become a key driver of growth, enabling more efficient resource management and improved crop yields.

Rising Demand for Compact Farming Solutions

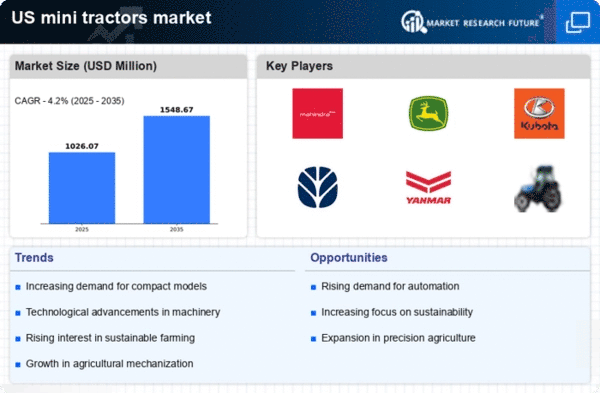

The mini tractors market is experiencing a notable increase in demand for compact farming solutions. As agricultural practices evolve, farmers are seeking equipment that can efficiently operate in smaller fields and urban settings. This trend is particularly pronounced in regions where land is limited, leading to a shift towards smaller, more versatile machinery. The market for mini tractors is projected to grow at a CAGR of approximately 6.5% over the next five years, driven by the need for efficient land use. Additionally, the affordability of mini tractors compared to larger models makes them an attractive option for small-scale farmers and hobbyists. This rising demand for compact solutions is likely to shape the mini tractors market significantly, as manufacturers adapt their offerings to meet the needs of this expanding customer base.

Government Incentives for Small-Scale Farming

The mini tractors market is benefiting from various government incentives aimed at promoting small-scale farming. In the US, initiatives such as grants and subsidies for purchasing agricultural equipment are encouraging farmers to invest in mini tractors. These incentives are designed to support sustainable farming practices and enhance food security. For instance, the USDA has allocated significant funding to assist small farmers in acquiring modern equipment, which includes mini tractors. This financial support is likely to stimulate growth in the mini tractors market, as more farmers are able to afford these essential tools. The combination of government backing and the increasing recognition of the importance of small-scale agriculture is expected to drive demand for mini tractors in the coming years.

Technological Integration in Agricultural Practices

The mini tractors market is being influenced by the ongoing technological integration within agricultural practices. Innovations such as electric-powered mini tractors and autonomous driving capabilities are becoming more prevalent. These advancements not only enhance operational efficiency but also align with the growing emphasis on sustainability in farming. The mini tractors market is likely to see an increase in demand for these technologically advanced models, as farmers seek to reduce their carbon footprint and improve productivity. The introduction of smart features, such as remote monitoring and diagnostics, is expected to attract a broader customer base. As technology continues to evolve, the mini tractors market is poised for transformation, potentially leading to a more sustainable and efficient agricultural landscape.