Increasing Cyber Threats

The rise in cyber threats is a primary driver for the bfsi security market in Mexico. With the increasing sophistication of cyber attacks, financial institutions are compelled to enhance their security measures. Reports indicate that cybercrime costs the financial sector in Mexico approximately $3 billion annually, highlighting the urgent need for robust security solutions. As a result, investments in advanced security technologies, such as intrusion detection systems and encryption, are surging. The BFSI Security Market is expected to grow as institutions prioritize safeguarding sensitive customer data and maintaining trust.. This trend is likely to continue as cybercriminals evolve their tactics, necessitating ongoing innovation in security protocols.

Consumer Awareness and Demand

Consumer awareness regarding data privacy and security is driving the bfsi security market in Mexico. As customers become more informed about the risks associated with digital banking, they increasingly demand higher security standards from financial institutions. This shift in consumer behavior has led to a notable increase in the adoption of security measures, such as two-factor authentication and biometric verification. Financial institutions are responding by investing in comprehensive security solutions to meet these expectations. The BFSI Security Market is likely to benefit from this trend., as institutions strive to enhance their security offerings to attract and retain customers.

Regulatory Landscape Evolution

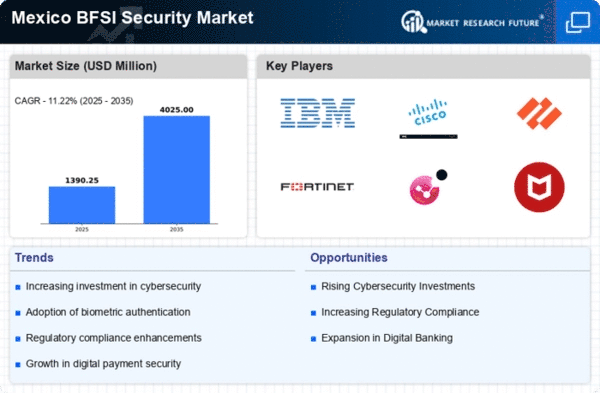

The evolving regulatory landscape in Mexico significantly impacts the bfsi security market. Financial institutions are required to comply with stringent regulations aimed at protecting consumer data and ensuring financial stability. The implementation of laws such as the Federal Law on Protection of Personal Data has prompted banks and financial service providers to invest heavily in compliance-related security measures. This has led to an estimated increase of 25% in spending on security solutions over the past year. As regulations continue to tighten, The BFSI Security Market is likely to expand further, driven by the need for compliance and risk management..

Digital Transformation Initiatives

The ongoing digital transformation initiatives within the financial sector are reshaping the bfsi security market in Mexico. As institutions adopt digital banking solutions and mobile applications, the demand for enhanced security measures grows. A recent survey indicates that 70% of financial institutions in Mexico plan to increase their cybersecurity budgets in response to digitalization. This shift not only enhances customer experience but also necessitates the implementation of advanced security technologies to protect against potential vulnerabilities. Consequently, The BFSI Security Market is poised for growth as organizations seek to balance innovation with security..

Technological Advancements in Security Solutions

Technological advancements are a crucial driver of the bfsi security market in Mexico. Innovations in security technologies, such as artificial intelligence and machine learning, are enabling financial institutions to detect and respond to threats more effectively. These technologies can analyze vast amounts of data in real-time, identifying potential security breaches before they escalate. As a result, The BFSI Security Market is experiencing a shift towards more proactive security measures.. Institutions that leverage these advancements are likely to gain a competitive edge, further fueling market growth. The integration of cutting-edge technologies is expected to redefine security strategies within the financial sector.